The Power of the PENsion

Private sector pension plans originated as early as 1875. By 1950, in our post-war manufacturing economy, more than 25% of the private sector workforce had a pension (or defined benefit) plan, offering employer-funded benefits with guaranteed payment (in lump-sum or in payment streams) at retirement.

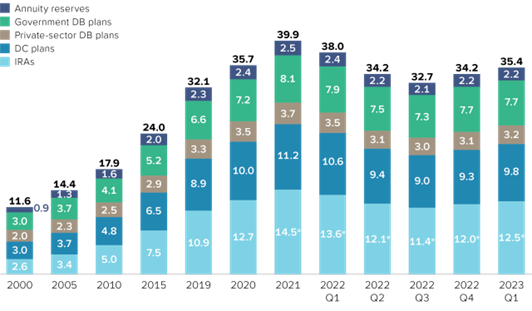

The advent of defined contribution plans like 401(k) plans, with a retirement savings burden shared by both employer and employee, ushered in declining access to and participation in defined pension plans. At the end of Q1 2023, total assets in private pension plans were at one-third of that in defined contribution (DC) plans. (See the diagram below.)

U.S. Total Retirement Market Assets[i]

Trillions of dollars, end-of-period, selected periods

A Department of Labor 2022 report on data collected from 5500 forms from 2020 showed that there were still 46,577 private pension plans being managed with almost 32 million participants. Approximately 85% (39,645) of that total were small employer plans with fewer than 100 participants.[i] Pensions and the benefits they provide are powerful and still relevant to retirement planning for millions of investors. For this reason, we’re pleased to provide a series of communications called The Power of the PENsion. These messages are designed to educate, update, and sometimes even entertain readers on pension-related topics. In this series, we’ll consider matters such as asset allocation and management, fiduciary responsibility, glide paths and de-risking, among others.

Next month, we’ll “Count the Costs of Your Pension Plan.”

Next month, we’ll “Count the Costs of Your Pension Plan.”

If you’d like us to consider addressing a topic of particular interest to you, please contact Mike Paolucci, mpaolucci@highlandusa.net or 440-808-1500.

[1] https://www.ici.org/statistical-report/ret_23_q1

Highland Consulting Associates, Inc. was founded in 1993 with the conviction that companies and individuals could be better served with integrity, impartiality, and stewardship. Today, Highland is 100% owned by a team of owner-associates galvanized around this promise: As your Investor Advocates®, we are Client First. Every Opportunity. Every Interaction.

Highland Consulting Associates, Inc. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer of solicitation for the sale or purchase of specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.