The Power of the PENsion: Labor Day and the Pension Plan

Pension Plans may be declining in numbers, but for millions of workers they are an essential retirement benefit with a history that is tied to Labor Day.

Although summer may end officially on September 21, for most Americans, the season ends with Labor Day. The first Labor Day was celebrated in 1882. Far from marking the end of summer fun, it was meant to be a “workingmen’s holiday” between the Fourth of July and Thanksgiving. Two years later, the first Monday in September became a national holiday to recognize America’s laborers.

The Labor Movement and Pension Plans

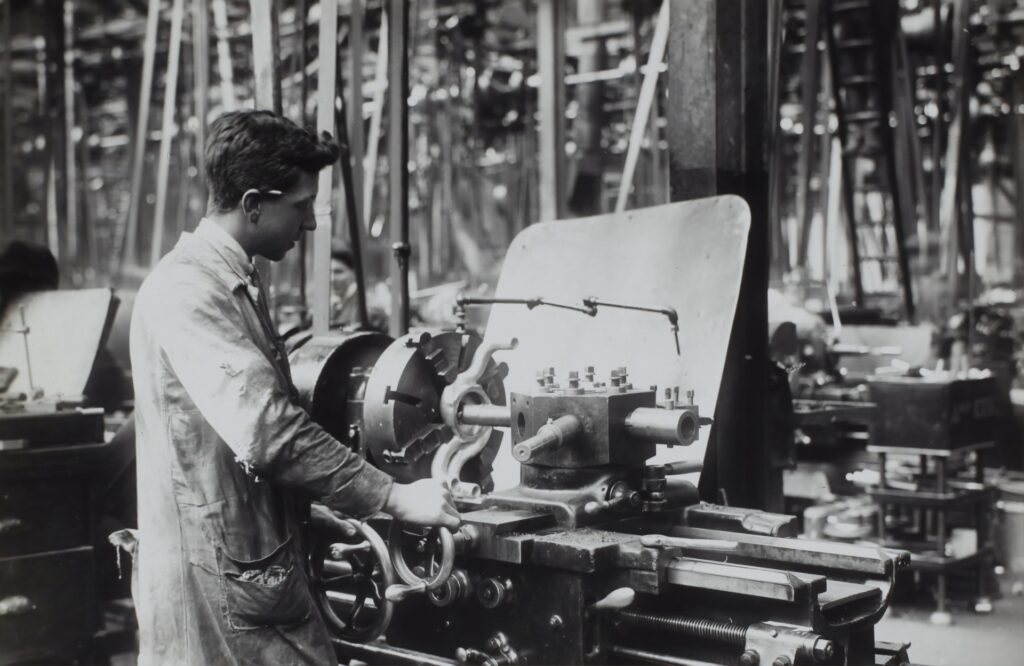

The holiday was part of a growing labor movement organized to protect and support American workers. Among other rights and protections, labor organizers fought for a benefit that would provide financial security for life after work and a dignified retirement—the pension plan.

American Express is credited with offering the first U.S. private pension plan in 1875 to reward retiring workers at 60 years of age with at least 20 years of service. In 1857, the first public pension plan was established for police officers in New York City. In the early twentieth century, these defined benefit (DB) plans emerged as a popular benefit among large manufacturers, utilities and banks. The employer-paid plans gained even more traction after World War II as a way to attract and retain talent. Over the decades that followed, pension plans became mainstays in benefit packages for government and unionized workers.

Broken Promises

Until 1974, private pension plans were largely unregulated. Many were poorly managed and inadequately funded. The most notorious example was the 1963 termination of the Studebaker pension plan which resulted in more than 4,000 auto workers losing some or all of their pension plan benefits. There were no guarantees or protections for these workers or others like them at companies unable to fulfill their pensions’ promises.

To better secure worker retirements, Congress passed legislation that President Ford signed into law on Labor Day in 1974. The Employee Retirement Income Security Act, or ERISA, was a landmark piece of legislation protecting the retirement security of working families. Though ERISA and its provisions don’t apply to public pension plans, in the private sector, ERISA regulates how the plans operate. The act also created the Pension Benefit Guaranty Corporation, which acts as a backstop for closed pension plans without the funds to pay promised benefits.

The Rise of the 401(k) Plan

Still popular in the unionized and public sectors, DB plans have largely fallen out of favor in the private sector. Here’s a primary reason why: In 1978, Congress passed The Revenue Act of 1978 in which Section 401(k) cleared the way for the establishment of defined contribution (DC) plans. This act initiated a retirement savings responsibility shift from employer to employee. These DC plans allowed employees to contribute their own earnings in a tax-advantaged way to supplement other retirement benefits, while providing tax incentives for employers to match those contributions. These popular 401(k) plans have become nearly ubiquitous benefits while pension plans have dwindled in number.

The chart below shows that in 1975, private-sector DB plans had a total of 27.2 million active participants, and private-sector DC plans had 11.2 million active participants. In 2019, (the most recent year for which there is data), private-sector DB plans had 12.6 million active participants (declining by more than half), and private-sector DC plans had 85.5 million active participants, (an increase more than seven-fold).

As mentioned, the picture is different in the public sector where DB plans continue to be offered to most employees. The same research service found that state and local public sector workers have access to DB plans (86%, compared with 15% of private sector workers), unlike private sector workers who are more likely to have access to DC plans (65%, compared with 38% of public sector workers).

Active Participants in Private-Sector Pension Plans 1975-2019

Source: Congressional Research Service; December 2021

The rise of 401(k) plans and decline of DB plans has led to headlines on the “death of pension plans.” But despite the decline, DB pensions remain an essential retirement savings tool for millions of working Americans, a tool that began with the labor movement and Labor Day.

If you’d like to talk further about your pension plan, please contact Mike Paolucci, mpaolucci@highlandusa.net or 312-833-5716.

Next month, we’ll look to further understand the costs associated with a pension plan.

Next month, we’ll look to further understand the costs associated with a pension plan.

Highland Consulting Associates, Inc. was founded in 1993 with the conviction that companies and individuals could be better served with integrity, impartiality, and stewardship. Today, Highland is 100% owned by a team of owner-associates galvanized around this promise: As your Investor Advocates®, we are Client First. Every Opportunity. Every Interaction.

Highland Consulting Associates, Inc. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer of solicitation for the sale or purchase of specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.