The Power of the PENsion: Where There’s a Window – Pension Plan Sponsors Moving to Act Before a De-Risking Window Closes

The equity and bond markets’ fall in recent months has captured the headlines and attention of anyone invested in a retirement plan. But as the rising rate environment has shaken the markets, it has helped improve the funding status of some pension plans and may have opened a window of opportunity for defined benefit (DB) plan sponsors to de-risk or even shrink the size of their plan obligations via partial or full termination.

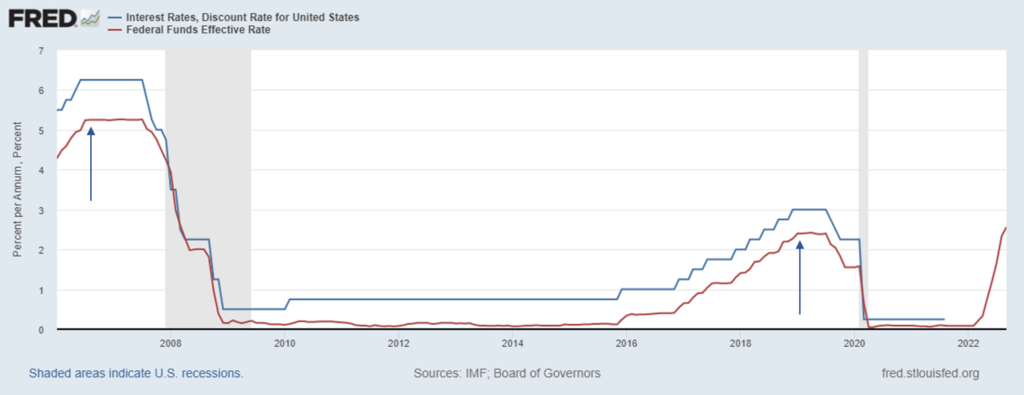

In 2022, equities, together with U.S. Treasuries and corporate credit, have suffered declines into bear market territories (Table). The steady drumbeat of stubborn inflation, tighter monetary policy, and rising interest rates led to an unprecedented decline in the bond market through the third quarter of 2022. Many major indexes plumbed new lows for the year at the quarter end. And while interest rates bottomed in the summer of 2020 (Figure), equities and other risk assets continued to rally through the beginning of 2022. This set up has produced a historic and nearly unprecedented decline in both the equity and bond markets, unlike the inverse correlation that existed for several decades.

| Asset Class | Index | Jul 2020 – Sep 2022 | Jan 2022 – Sep 2022 |

|---|---|---|---|

| Core Bond | Bloomberg US Aggregate Bond | -15.90% | -14.61% |

| US Interm Treasury | Bloomberg US Intermediate Treasury | -10.48% | -8.70% |

| US Interm Credit | Bloomberg US Intermediate Credit | -10.84% | -11.33% |

| US Long Treasury | Bloomberg US Long Treasury | -36.21% | -28.84% |

| US Long Credit | Bloomberg US Long Credit | -28.93% | -29.05% |

| US Equities | S&P 500 | 13.79% | -23.87% |

| International Equities | MSCI EAFE | -5.34% | -26.76% |

A Reason for Optimism among DB Plan Sponsors

But while the last nine months have been among the worst periods of market performance on record, for DB plans, the news may be quite good. Because, despite a dismal period across asset classes, rising interest rates have actually decreased the value of their liabilities, and in some cases, more than offsetting investment losses to improve the funded status.

Jeff Bauer, president and principal of the Angell Pension Group, a leading third-party administrator and employee benefit advisor, told Highland, “For many plans, the decrease in liability due to higher interest rates is greater than the asset losses that have occurred during 2022, which increases the plan’s funded percentage.

In fact, as of September 30 among the largest 100 pension plans, the funded ratio increased at the end of August, and the funded status surplus also increased.[i]

Windows That Were Missed

The current rising rate environment (Figure) that began in the summer of 2020, alongside improving funded status is a striking reminder that a similar dynamic was in play just prior to the Global Financial Crisis in 2007-2009, and again, for a shorter period in 2019. Sponsors who may have missed these windows to de-risk or reduce the size of their plan obligations might be considering—and rightfully so—how to take advantage of this opportunity now, before it ends.

According to Bauer: “Many plan sponsors have been waiting for this opportunity, and we are seeing a significant increase in the number of plan sponsors initiating partial annuity settlements, lump sum window cash outs or full plan terminations.

“Most plan sponsors looking to terminate their plans are beginning the process now so that lump sum distributions can be completed in the 2023 plan year, when current interest rates begin to apply for purposes of lump sum distributions (most plans utilize a one-year stability period for lump sum interest rates, so current rates will not apply until 2023).

“Further, because annuity settlement interest rates vary continuously and could begin to retreat at any time, plan sponsors looking to settle a portion of their liability, for example, by purchasing annuity contracts for some retirees, are generally moving more quickly to settle liabilities before the end of 2022.”

Act Now

Pension plan sponsors may be the one group to see some sunlight in an otherwise gloomy economic environment. Whether you choose to de-risk or end the plan in a partial or total termination, now is an opportune time to review the funded status of the plan and the appropriateness of the current investment strategy based on what could be shifting goals and objectives. Is it still effective for the changes we’ve witnessed and the expectations we have for 2023? Are there asset allocation portfolio structure adjustments to consider now?

What history continues to instruct is that change is constant and windows eventually close.

Highland has been advising pension plan sponsors since 1993. If you’d like to talk through your plan’s funded status and adjustments you may want to consider now, contact Mike Paolucci at 440.808.1500.

[i] https://www.milliman.com/en/insight/pension-funding-index-october-2022

Highland Consulting Associates, Inc. was founded in 1993 with the conviction that companies and individuals could be better served with integrity, impartiality, and stewardship. Today, Highland is 100% owned by a team of owner-associates galvanized around this promise: As your Investor Advocates®, we are Client First. Every Opportunity. Every Interaction.

Highland Consulting Associates, Inc. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer of solicitation for the sale or purchase of specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.