Throwing Darts in the Dark: Reasons to Review Your DB Plan Glide Path

For an employer, the ultimate goal of a defined benefit (DB) plan is to provide the retirement benefits promised to retirees. To accomplish this goal of funding those benefits and the related costs of providing them, an investment portfolio must generate sufficient returns—or a targeted rate of return (ROR). Asset allocation, or the practice of dividing an investment portfolio among the major asset categories of equities, fixed income, cash equivalents, and alternatives, is how plan sponsors (with their investment advisors) achieve returns to pay those future obligations. The DB plan glide path adjusts that mix of investments over time, aiming to reduce risk, i.e., shifting portfolio assets from equities to fixed income investments, as the plan approaches fully funded status. Sounds simple enough, at least in theory. And that’s where the simplicity ends.

Glide paths might seem like a straightforward strategy arriving at a fully funded status, but there are variables at play that complicate asset allocations for a DB plan’s target rate of return to fully fund those promised benefits. Among those variables are:

- Whether the plan is open, frozen or closed,

- The plan’s current funded status,

- Plan sponsor risk tolerance,

- Plan sponsor contributions (though few plan sponsors choose to make these, preferring, instead, for plan investments to meet the goal),

- Economic conditions externally and within the company,

- Expectations for volatility in interest rates and capital markets, and

- Size of the plan relative to the business and impact on company financials.

Given the unique nature of each plan, the final allocation and intermittent glide path steps will vary, in large part by its status—open, frozen, or closed, and to what degree the plan is funded. To illustrate how some of these particular variables impact the required rate of return, consider the charts below and the differences among these simplified example plans.

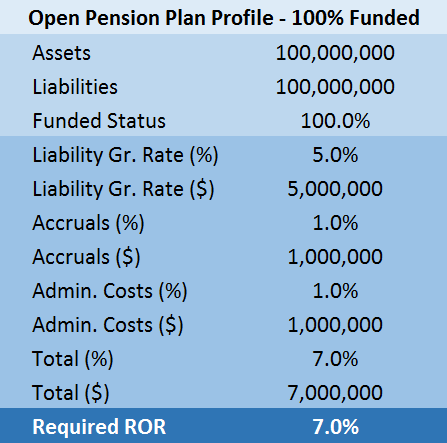

Plan One: Open Plan and 100% Funded

In this example, the fully funded plan at $100 million in assets has to achieve returns to fund future liabilities growing at 5%, accruals for participants enrolled in the plan of 1%, and another 1% in fees to administer the plan. The target rate of return in this case is 7%, to earn the $7 million that the sponsor is obligated to pay out every year. This is the theory behind the investment return target for DB Plan One. If Plan assets grow at the same rate as the liability discount rate and then some more—at least enough to cover new, future benefits accrued and related plan fees, then at a rate of return of 7%, the plan has the exact amount needed to pay out retirement benefits.

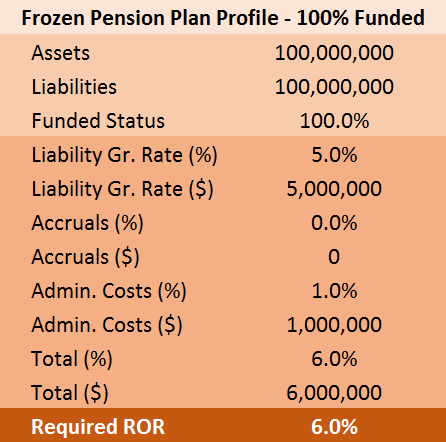

Plan Two: Frozen Plan and 100% Funded

Consider Plan 2, an even easier example to consider because the plan is frozen. Since frozen plans are closed to new entrants, and current participants no longer accrue benefits, the estimation of future liability is somewhat more predictable and more modest, too. In this case, the required rate of return must continue to match the growth of liabilities and the plan administrative costs. Asset allocation for this plan, fully funded, has likely shifted from return-seeking assets (equities) to liability-hedging assets (fixed income securities) as the plan’s funding status has improved toward its funding goal (generally 100% to 105%).

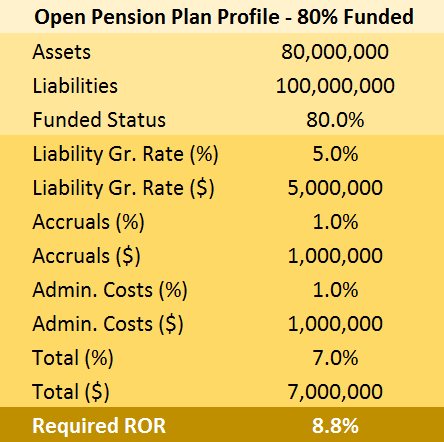

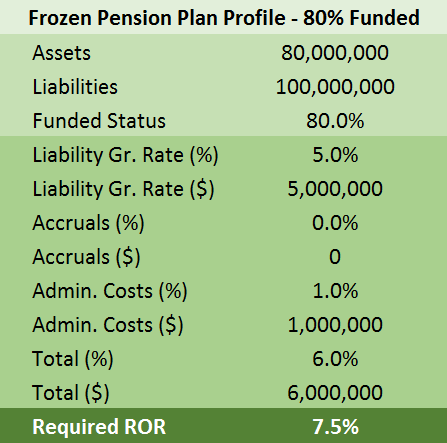

Plans Three and Four

Plans 3 and 4 illustrate the same principles, requiring higher rates of returns, and likely greater reliance on equities to close the asset-liability gap of a plan that is only 80% funded.

If we could stop time, these examples would be easy to plan for. In practice (and since time waits for no one), the glide paths that achieve required rates of return must be revisited at least annually, if not more often. The target may not move, but everything around it does. Changes in interest rates take the value of those liabilities up or down. Those changes in value and equity market movement, up or down, requires more or less risk to close a funding gap, and available fixed assets to hedge any difference may or may not be available at the quality desired.

Because of market dynamics and the other plan variables discussed, determining the appropriate asset allocation model for a DB plan is complicated. No single asset allocation model is right for every plan, and no plan is appropriate in every season or economic cycle. The immediate challenge is to pick the mix of assets that has the highest probability of meeting the plan’s goals, at an acceptable level of risk. The ongoing challenge is to monitor those allocations along a glide path as financial markets and economic conditions change. With regular monitoring, achieving a targeted rate of return is a reasonable expectation. Without regular monitoring, hitting the bullseye of a targeted rate of return may be a little more like throwing darts in the dark.

Highland regularly meets with plan sponsors to revisit, review or revise DB plan glide paths. You can learn more by reading our recent message on glide paths here, or, better, call Mike Paolucci at 440.808.1500.

Highland Consulting Associates, Inc. was founded in 1993 with the conviction that companies and individuals could be better served with integrity, impartiality, and stewardship. Today, Highland is 100% owned by a team of owner-associates galvanized around this promise: As your Investor Advocates®, we are Client First. Every Opportunity. Every Interaction.

Highland Consulting Associates, Inc. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer of solicitation for the sale or purchase of specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.