Understanding the New Fiduciary Rule and Its Impact to Retirement Plan Sponsors

UPDATE: On February 3, 2017 President Trump issued a memorandum directing the Department of Labor (DOL) to consider revising or rescinding the DOL Fiduciary Rule. (This rule, some 1,023 pages in length, expands the definition of an “investment advice fiduciary” and significantly increases the universe of those legally and ethically bound by the Employee Retirement Income Security Act of 1974 (ERISA) standards that govern fiduciaries.)

Following this direction, on February 9, 2017, the DOL submitted a proposed rule to delay the applicability date to the Office of Management and Budget (OMB). As of this writing, the Fiduciary Rule’s applicability date is April 10, 2017.

Here‘s the process related to the proposed delay and what you can expect to occur:

- The proposal must be reviewed by the OMB. Most likely, the office will approve the proposal. If approved, the DOL will publish the proposed rule in the Federal Register.

- After the proposal has been published, a comment period will begin on that date.

- Once the comment period closes (which could be as short as 14 days) the Department of Labor will review the comments and prepare a final rule. The final rule must be submitted to the OMB.

- If, following their review, the OMB approves the final rule, the DOL will publish the final rule in the Federal Register, formally adopting the new applicability date.

During the comment period, interested parties will have the opportunity to weigh in on the merits and design of the rule, whose primary purpose was to raise the standards for investment advice for investors in retirement plans, IRAs and other retirement vehicles. The DOL may take the period of time offered by the delay in the applicability date to either revise or replace the current rule.

Update on recent court case affecting the Fiduciary Rule:

On Feb. 8, 2017 a federal district court in the Northern District of Texas rejected challenges to the DOL rule. Ruling in favor of the DOL on all counts, the court rejected the plaintiffs’ following arguments that:

- The DOL exceeded its statutory authority under ERISA and/or its exceptive authority in issuing the fiduciary rule and related exemptions

- The new exemptions impermissibly created a private right of action, and

- The rulemaking process violated the Administrative Procedure Act.

On the same day, the Department of Labor had requested that the court hold off on issuing a ruling until at least March 10th. Court rejected the request, and issued its ruling.

Proponents of the DOL rule and those who oppose it are likely to be at odds over its value to investors and its implementation timeline in the months to come. Meanwhile, plan sponsors and vendors will continue to dedicate time and resources to comply with the rule, made more onerous by having to anticipate the outcome of the Fiduciary Rule debate.

While we can’t predict the outcome, Highland will provide regular updates regarding the status of the Fiduciary Rule.

Redefining a Retirement Plan Fiduciary

On April 8th 2016 the US Department of Labor (DOL) released a final regulation which redefines a retirement plan “fiduciary.” The final rule follows several years of discussion and debate and affects plan sponsors in important ways.

But you’re probably wondering:

“Is this a game-changer and what does the final language of the new fiduciary rule mean to me or to my Plan?”

In a few cases, plan sponsors may have to take action to avoid additional liability risk. Most significantly, the rule more broadly defines fiduciaries to include additional types of service providers. Many advisers who historically had not been subject to fiduciary liability in the past will now be subject to that liability going forward. As a result, plan sponsors can expect many advisers and consultants to alter their advice models to comply with the new requirements. Despite these changes, however, possibilities for conflicts of interest remain. The rule’s approach to conflicts of interest still favors the management of conflicts over their systemic elimination.

Retirement plan sponsors should still ask detailed questions of their advisers to understand the potential for biased or conflicted advice.

In this white paper we summarize key features of the rule, highlighting issues which may directly impact plan sponsors. Finally, we suggest several questions plan sponsors should ask their consultants to improve transparency.

Before we begin, let’s back up a bit and start from the outset.

The Fiduciary Rule Background

The fiduciary rule dates back to the 1970s. In response to notable pension failures and shortfalls in payments to beneficiaries, Congress passed the Employee Retirement Income Security Act of 1974 (“ERISA”). This act mandated a fiduciary standard for those who manage or advise pension plans.

Key components of the framework included:

- The required duty of loyalty to plan beneficiaries. Certain decisions must be made solely in the interest of beneficiaries

- A prohibition on a set of transactions (“prohibited transactions”) that would create a conflict between a plan manager and a plan beneficiary, for example self-dealing / sweetheart transactions

- Liability for breaches of duty that can hold individuals responsible to restore losses from their personal assets

Old Rule Meets New Standard: Who Is a Fiduciary Under ERISA?

Section 3(21)(A) of ERISA states that a person is a fiduciary to a retirement plan if they meet any of the following criteria.

- Exercise any discretion or control with respect to management of plan assets; for example, a pension committee which can make investment decisions

- Render investment advice for a fee or other compensation, direct or indirect, with respect to plan assets; for example, an investment consultant

- Have any discretionary authority in the administration of a plan

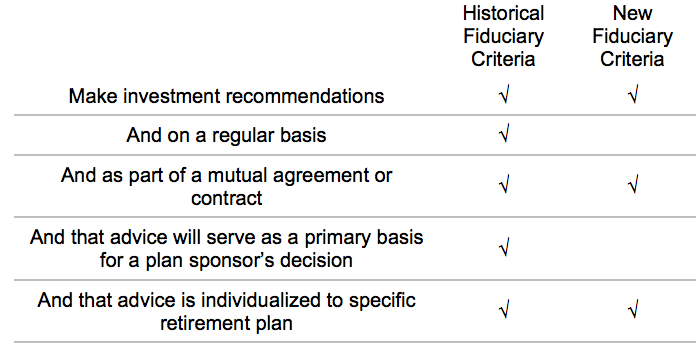

Originally, to be considered a fiduciary by way of providing investment advice, an adviser’s activity had to meet all 5 of the criteria in figure 1 below.

Many advisers argued they were exempt because their advice didn’t meet one or more of the criteria. For example, in a fine print disclosure, an adviser might state that their investment advice is not intended to be the primary basis for decisions. Other advice on a one-time basis such as a group annuity purchase might also have been exempt.

OK. So you understand the difference, now what?

These commonly used exceptions no longer apply. Even if the advice is not provided regularly or used as the primary basis for decisions, under the new rule, the adviser is now subject to fiduciary liability and compliance requirements.

Figure 1: Criteria to be Rendering “Investment Advice”

The impact of this change will be to include a large number of advisers who previously were not considered fiduciaries. These firms and individuals will now be considered fiduciaries to retirement plans with the attending obligations and responsibilities.

Direct Implications for Plan Sponsors

What you need to understand…

Providing “education” and not “advice” to individual participants.

The definition of advice also contains a number of exceptions which characterize various acts as “education” rather than “advice.” This is particularly relevant for defined contribution plan sponsors who wish to provide education to plan participants while avoiding liability and compliance risks associated with providing “advice” directly to individual plan participants.

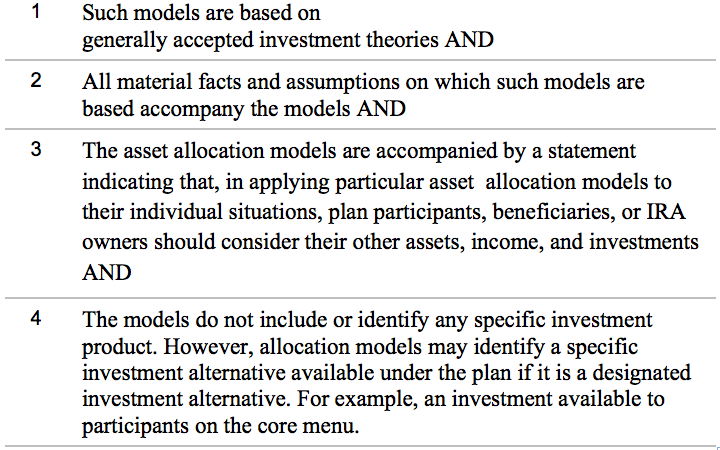

The Department of Labor specifies several criteria under which specific model portfolios or asset allocation examples can be provided to plan participants in the context of employee education.

Figure 2: Criteria for Sample Portfolios to be Considered Education and not Advice

Plan sponsors may need to review and/or update any existing education materials that make reference to hypothetical or example portfolios.

Fiduciary liability extends to IRA rollovers:

In addition, fiduciary advice now will extend also to advising individual participants on moving their assets out of a retirement plan and rolling over assets to an IRA. Those who advise participants on rollovers will be subject to a number of new conflict of interest procedures and documentation requirements.

Plan sponsors should review what communications are given to participants regarding rollovers. Direct communication and material should be reviewed as well as materials and scripts used by plan administrators and recordkeepers. Plan sponsors who design plans with the expectation that most participants will roll over to IRAs at retirement may need to re-evaluate those designs. It is possible that fewer advisers and / or service providers will want to engage participants in conversations about rollovers for fear of additional liability.

If this happens, more participants at retirement may keep their investments in their employer’s retirement plans. An important consideration is the design or selection of target date funds. A future may exist where plans could have more 75 or 80+ year-old participants who are invested in target date funds. This rule change may prompt a re-evaluation of those funds.

Relief and exceptions to protect employers and staff:

The DOL specifically exempts certain employees from the fiduciary standard when providing advice as part of their employment. If an employee is not receiving supplemental compensation in connection with providing advice, and if an employee is operating within the scope of his or her job, the fiduciary rule and compliance requirements generally do not apply.

In the final rule, the DOL also clarified that employees who create reports or make recommendations for their company’s plan are also generally exempt.

Implications for Consultants: What Questions Should Plan Sponsors Ask?

photo credit: Question

photo credit: Question

Background on the requirements of ERISA fiduciaries:

ERISA section 406(b)(2): a fiduciary shall not “in his individual or in any other capacity act in any transaction involving the plan on behalf of a party (or represent a party) whose interests are adverse to the interests of the plan or the interests of its participants or beneficiaries.”

In plain English: Fiduciaries must always act in the best interests of plan beneficiaries above other parties. For example, fiduciaries cannot choose to purchase plan assets from themselves. A low price would harm the fiduciary personally but benefit the plan. A high price would harm the plan but benefit the fiduciary personally.

“ERISA section 406(b)(3) and Code section 4975(c)(1)(F) prohibit a fiduciary from receiving any consideration for his own personal account from any party dealing with the plan . . . in connection with a transaction involving assets of the plan. . .“ Federal Register. Retrieved from https://s3.amazonaws.com/public-inspection.federalregister.gov/2016-07927.pdf

Translation: Fiduciaries cannot receive compensation related to plan transactions. For example, individuals or firms cannot receive commissions that are related to plan transactions where they are a fiduciary.

Does the new rule eliminate conflicted activities such as receiving commissions or selling proprietary products?

No. Under the new rule, these acts are still allowed but are subject to an expanded set of rules:

Advisers can still engage in prohibited transactions if they conform to an allowed exemption. The broadest exception is referred to as the “Best Interest Contract Exemption” or “BICE.” The BICE exemption permits advisers to engage in conflicted activities if they:

- Acknowledge fiduciary status

- Adhere to the “Impartial Conduct Standards” which require that they:

- Give advice in the best interest of the retirement plan investor without regard to the adviser’s, adviser employer’s, or adviser affiliate’s interest

- Charge no more than reasonable compensation

- Make no misleading statements and disclose all conflicts of interest

- Implement policies and procedures reasonably and prudently designed to prevent violations of the Impartial Conduct Standards

- For example, firm wide monitoring of adviser activity and recommendations

- Refrain from giving or using incentives for Advisers to act contrary to the customer’s best interest; and fairly disclose the fees, compensation, and material conflicts of interest, associated with their recommendations

- Examples include quotas, appraisals, performance or performance or personnel actions, bonuses, contests, special awards, differential compensation or other actions or incentives

Advisers who conform to these standards are allowed to accept a wide variety of compensation that would otherwise be prohibited.

The Department of Labor describes several underlying principles and interpretations of the rule. In the final rule release, the DOL clarified that the intent is not to prevent other types of compensation. Different compensation for different products is still allowed if it doesn’t “tend to encourage” biased recommendations.

“The exemption takes a principles-based approach that permits Financial Institutions and Advisers to receive many forms of compensation that would otherwise be prohibited, including, inter alia, commissions, trailing commissions, sales loads, 12b-1 fees, and revenue-sharing payments from investment providers or other third parties to Advisers and Financial Institutions.” Federal Register. Retrieved from https://s3.amazonaws.com/public-inspection.federalregister.gov/2016-07925.pdf

“[in response to industry comment] “the Department has specifically revised the . . . .text to make clear that differential compensation is permissible, and has changed the prohibition on incentive structures that would “tend to encourage” violations of the Best Interest Standard to a prohibition on incentive structures “intended” or “reasonably expected” to cause such violations” Federal Register. Retrieved from Ibid

Furthermore, firms can pay individual advisers higher fees for different products, if those fees can be justified based on time, effort or complexity.

“the requirement does not: prevent the Financial Institution . . . from providing Advisers with differential compensation based on investments by Plans. . . based on such neutral factors as the difference in time and analysis necessary to provide prudent advice”. Federal Register. Retrieved from https://s3.amazonaws.com/public-inspection.federalregister.gov/2016-07925.pdf

Implications: What Plan Sponsors Should Ask Their Advisers Using the “Best Interest Contract Exception”

Varying Compensation for Different Investments:

Advisers may continue to receive compensation that varies with the types of investment selected by plan sponsors. This presents a conflict of interest. Advisers stand to be more highly compensated if certain products are selected. One of the key rationales contemplated by the DOL is that some products are more complex to analyze or monitor. Under the new fiduciary rule framework, advisers can justify higher compensation for themselves by arguing that certain products are inherently more complex.

Per the DOL rule:

“For example, in many circumstances, it may require more time to explain the features of a complex annuity product than a relatively simpler mutual fund investment. Based on such neutral considerations, the Financial Institution’s policies and procedures could permit the payment of greater commissions in connection with annuity sales”. Federal Register. Retrieved from Ibid

Accordingly, plan sponsors should continue to scrutinize their advisers’ compensation models and the circumstances under which they can be more highly paid.

We suggest sponsors ask:

“What is your compensation for the investments recommended?”

“Are there other investments options that can be provided at a lower compensation rate and lower all-in cost?”

“What is the rationale for different compensation for these investments?”

Limited or proprietary menus of solutions:

Advisers still have the ability to limit menus of products available to plan sponsors. In its rulemaking, the DOL contemplates this possibility.

“Section IV(b) such Financial Institutions and Advisers shall be deemed to satisfy the Best Interest standard of Section VIII(d) if: (1). . . . the Retirement Investor is clearly and prominently informed in writing that the Financial Institution offers Proprietary Products or receives Third Party Payments with respect to the purchase, sale, exchange, or holding of recommended investments; and the Retirement Investor is informed in writing of the limitations placed on the universe of investments that the Adviser may recommend to the Retirement Investor.” Federal Register. Retrieved from https://s3.amazonaws.com/public-inspection.federalregister.gov/2016-07925.pdf

Limiting the universe of investment options has been a common industry practice, and it could continue. Retirement plan sponsors should ask about investment solutions their advisers are limiting as well as those proprietary products that they promote.

We suggest sponsors ask, among others:

“What limitations exist on the types of available investments?”

“Are there other investments available outside of your platform that may be more effective?”

“How does an investment become available on your platform? What prevents investments from becoming available?”

The best interest contact exemption does impose new disclosure requirements on advisers. Nevertheless, a wide variety of potentially conflicted practices are still allowed under the rule.

Advisers can still collect variable compensation and limit menus of products or solutions to clients. Plan sponsors cannot rely on the rule as a guarantee they will receive unbiased advice.

What Plan Sponsors Should Know and Ask Regarding Principal Transactions

Background on the principal transactions exemption and other types of allowed principal transactions:

While the BICE exemption allows a wide variety of compensation methods, one method of compensation that concerns the DOL is principal transactions.

In a principal transaction the investor buys directly from or sells directly to an adviser. Advisers cannot use the best interest contract to facilitate principal transactions, and the inherent risk for abuse in these types of transactions is great.

The issue can be simply thought of as a zero-sum game.

Depending on the price paid, the adviser’s gain equals the investor’s loss. The adviser’s loss is the investor’s gain. The DOL created a separate and arguably more limited set of exemptions for advisers with regard to principal transactions.

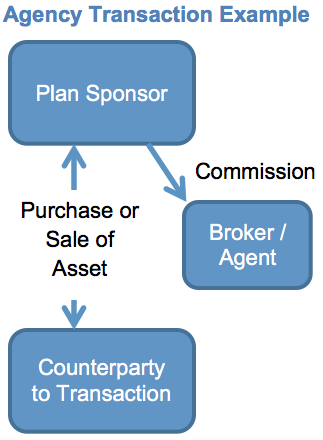

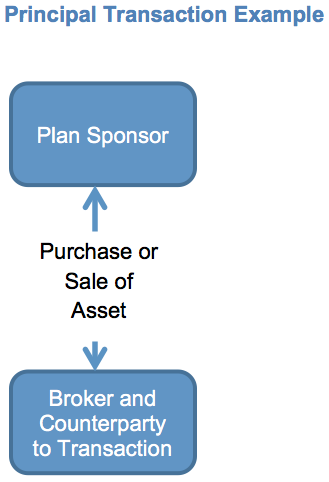

Figure 3: Agency vs Principal Transactions

Figure 3 to the left illustrates the difference between an agency transaction (allowed under the BICE) and a principal transaction. An agency transaction is analogous to how most people sell homes with the assistance of a realtor.

The agent is paid a commission to find a counterparty to buy from or sell to. The agent may also assist in negotiating a price on behalf of its client. It may also assist with certain operational issues in actually executing a trade.

In securities markets, commissions are typically framed as a cents per share rate. If a buyer is seeking to transact a certain number of shares, the agent’s incentive is to see the trade executed. The agent has less incentive tied to the actual price of execution.

In contrast, a principal transaction is directly adversarial. In this case, the plan sponsor faces counterparty with directly opposing interests – by construction.

In contrast, a principal transaction is directly adversarial. In this case, the plan sponsor faces counterparty with directly opposing interests – by construction.

If the plan sponsor is a buyer, it wants a low price for a transaction. The seller wants a high price. If the plan sponsor is a seller, it wants a high sales price. In this case, the buyer or counterparty wants a low price.

The DOL seems to appreciate the strong conflict of interest in a principal transaction. The best interest contract exemption may not be used for principal transactions.

Advisers looking to execute principal transactions with their clients must rely on a specific Principal Transactions Exemption or other specific exemptions provided

Types of principal transactions allowed

Four major types of principal transactions are allowed under the exemptions.

- Purchases of certain debt securities

- Sales of securities or real property

- Certain insurance, annuity or mutual fund products

- “Riskless” principal transactions are also allowed

Advisers are generally permitted to engage in these transactions with clients if they meet criteria similar to the best interest contract exemption criteria. Advisers must acknowledge fiduciary status, adhere to impartial conduct standards and implement policies intended to prevent violations of those standards.

- Purchases of certain debt securities:

Clients can buy certain debt securities directly from advisers. The final rule has criteria for the types of bonds that apply, and also requires bonds to be of a minimum credit quality and liquidity. Notably those criteria are not precise.

In the words of the Department of Labor:

“An eligible bond must ‘possess at the time of purchase no greater than moderate credit risk and sufficient liquidity that it can be sold at or near its carrying value within a reasonably short period of time.’” Federal Register. Retrieved from http://webapps.dol.gov

2. Sales of securities or real property:

Clients can sell a wide variety of securities directly to their advisers in principal transactions under the rule. Presumably this was changed in the final rule to allow retirement plans more ways to exit certain types of investments.

3. Certain insurance, annuity or mutual fund products:

Technically, many insurance or mutual fund purchases can be thought of as principal transactions, where a purchaser directly faces an insurer. The insurer benefits from a high purchase price from a client.

Clients benefit from lower purchase prices so the conflict of interest dynamic is similar to what we described previously. Fixed annuity sales are allowed without reliance on the best interest contract exemption.

4. “Riskless principal transactions”

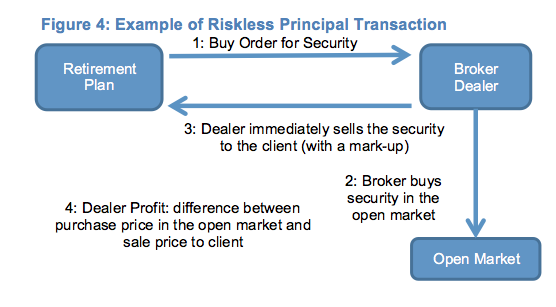

Figure 4 illustrates an example of a riskless principal transaction.

Figure 4: Example of Riskless Principal Transaction

In a riskless principal transaction a broker/dealer doesn’t buy or sell from its own inventory of securities. Instead it enters the market and simultaneously offsets the transaction with its client.

In this example, the broker enters the market to buy a security in the market. It then simultaneously sells that security to its client at a markup. The markup is compensation for services provided.

The original DOL proposal in 2015 contained a requirement that mark-ups and mark-downs be disclosed to clients. The “Department. . . . eliminated a mark-up and mark-down disclosure requirement in the final version. ” Federal Register. Retrieved from https://www.federalregister.gov/articles/2016/04/08/2016-07926/class-exemption-for-principal-transactions-in-certain-assets-between-investment-advice-fiduciaries

Advisory firms must disclose the circumstances under which the individual adviser and firm may engage in principal transactions and riskless principal transactions with the plan and material conflicts of interest. Disclosure of exact amounts of compensation for principal transactions is not a general requirement.

Investors should ask about and understand these methods of compensation if their consultant uses principal transactions.

What plan sponsors need to know and ask

We suggest sponsors ask several questions of their consultants with regard to principal transactions:

“What mark-up or mark down rates are you charging for riskless principal transactions?”

“How do you prevent excessive transactions from being recommended or implemented?”

“What is your total compensation for principal transactions you have conducted with us?”

Some financial institutions may be reluctant to disclose mark-up or other profit information related to principal transactions. Some may respond that the profit on principal transactions is difficult to measure precisely or that some aspects of determining profitability depend on a number of assumptions.

Nevertheless, banks and broker-dealers internally estimate and measure their profits from trading activity on an ongoing basis as frequently as daily. Even if an exact compensation number is challenging to calculate, providers should be able to provide reasonably accurate estimates of their profit from these activities.

What Investors Need to Know: Commission Free Arrangements

Commission free does not necessarily mean free:

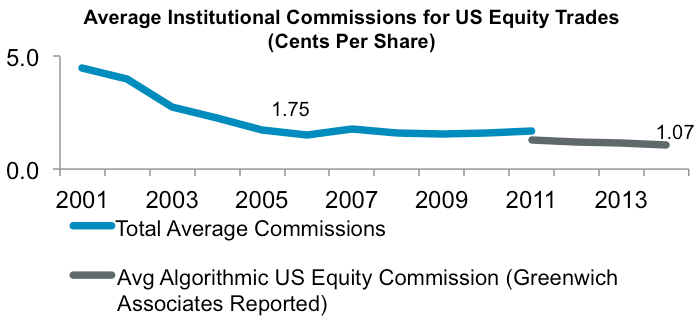

Over the past decade, commission rates have generally fallen and become less important drivers of total trading revenue for brokers. Markets have become increasingly fragmented. Other less transparent sources of compensation have become more important as commission rates have fallen.

Figure 5 illustrates the long term decline in commission rates in the US

Figure 5: Declining Explicit Brokerage Commissions

While commission rates have generally fallen, markets have become increasingly fragmented. Much of equity trading occurs in “dark pools” away from traditional exchanges. Some trades are internalized entirely inside a broker-dealer.

Broker-dealers have a number of ways they can profit from client trading activity. As commissions decline, these less transparent sources of revenue increase in importance. Even “commission-free” transactions can be profitable for a broker-dealer and costly to investors.

Unfortunately because of these issues, investors cannot prudently accept “commission-free” as free. Investors should ask deeper and more precise questions of any consultant which executes trades for its clients.

Suggested Question: “Do you internalize order flow from clients? Would you internalize our order flow?”

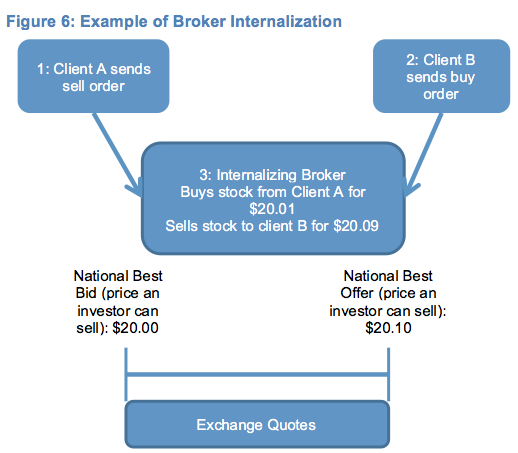

What is internalization and how does a broker profit?

Internalization is the internal execution of orders against a broker’s inventory without the broker needing to send it to an external venue such as an exchange. In the US, brokers are allowed to do this if they offer “price improvement” relative to the best displayed prices available in a market. In this example, Client A wishes to sell.

The best price in the market is $20.00. The broker can take that order and sell to the client from its own inventory at $20.01. Client A has been given a slightly better price in the process.

Figure 6: Example of Broker Internalization

Concerns about internalization are related to the prices where trades execute, and the ability of brokers to selectively trade for their own accounts in the process.

Several studies suggest that the widespread practice of internalization limits the competitiveness of quotes that are publicly disseminated to exchanges, which leads to inferior prices for all investors. For example, CFA Institute’s November 2012 Issue Brief https://www.cfainstitute.org/ethics/Documents/dark_pools_internalization_and_equity_market_quality_final_issue_brief.pdf

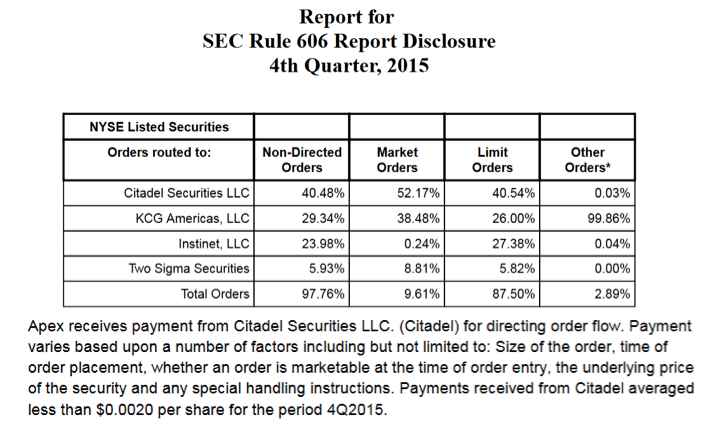

Suggested Question: “Do you sell client order flow to internalizers or other entities? Please provide a copy of your SEC Rule 606 disclosure and details of your order flow arrangements.”

Many brokers increasingly sell orders to organized venues outside of exchanges. Rather than internalize an order itself, a broker can send its order to an “internalization pool” where multiple brokers can send orders for fulfillment.

Many of these pools will pay brokers a fee to send their orders to these pools. A comprehensive discussion of the underlying market structure issues is beyond the scope of this white paper. However, the issue at hand can be relatively simply framed.

Under the existing market structure, client trade orders have inherent economic value for certain trading entities. An entity would only willing to pay a fee on an ongoing basis to receive orders if it had an expectation of recouping that fee plus some profit based on activities related to that order.

Figure 7: Example Rule 606 Disclosure

Summary and Conclusions

The full text of the fiduciary rule with DOL discussion is over 1,000 pages. The long-term implications and impact to the retirement advice industry will be seen.

In the near term, we recommend plan sponsors evaluate three key issues that may directly impact them.

1. Review existing employee education materials to confirm compliance with the new rule.

2. Evaluate the potential for more employees to remain in the plan at retirement. Review plan design and investment options for suitability if more employees remain in the plan.

3. Review internal employee activities related to the plan and assess any potential compliance risks under the new rule.

We also suggest 11 specific questions that sponsors should ask their consultants. These questions will be particularly relevant to consultants who sell products on a commission basis, principal basis, have affiliated broker / dealers or affiliated investment managers.

11 Essential Questions for Plan Sponsors to Ask Advisers:

Variable compensation based on the investments selected

1. “What is your compensation for the investments contemplated?”

2. “Are there other investments available where your compensation is less?”

3. “What is the rationale for different compensation for these investments?”

Proprietary or limited menus of investments

4. “What limitations exist on the types of available investments?”

5. “Are there other investments available outside of your platform that may be more effective?”

6. “How does an investment become available on your platform? What prevents investments from becoming available?”

Principal transactions

7. “What mark-up or mark down rates are you charging for riskless principal transactions?”

8. “How do you prevent excessive transactions from being recommended or implemented?”

9. “What is your total compensation for principal transactions you have conducted with us?”

Brokerage practices

10. “Do you internalize order flow from clients? Would you internalize our order flow?”

11. “Do you sell client order flow to internalizers or other entities? Please provide a copy of your SEC Rule 606 disclosure and details of your order flow arrangements.”

The new fiduciary rule implements new safeguards for retirement plan investors. However, the rule does not guarantee that investors will receive unbiased advice. The rule approaches conflicts of interest from a perspective of mitigation versus elimination.

Written procedures and disclosures are the practices emphasized in the rule. Important metrics such as actual compensation received are absent from many of the final rule’s disclosure requirements. Disclosure is good for the industry. However, as anyone who’s read lengthy disclosures knows, the longer the list of required disclosures, typically the more potential conflicts and future issues.

Retirement plan investors must continue to be vigilant, skeptical and ask detailed questions of the firms and people that would advise and serve them.

For more information relevant to evaluating advisers as well as their objectivity and any potential conflicts of interest, click the image below.