UNTAPPED: Despite CARES Act Provisions, Retirement Savers Leave Balances Untapped and Benefit from Staying the Course

In March 2020, Congress passed the $2 trillion relief package “Coronavirus Aid, Relief, and Economic Security Act” (CARES Act) to provide emergency assistance for individuals, families, and businesses affected by the coronavirus pandemic. Among other provisions, the CARES Act made accessing a retirement saver’s qualified plan balances easier and less costly.

Through December 2020, individuals can take a coronavirus-related distribution (CRD) from their 401(k) account of 100% of their account balances (up to $100,000) without incurring the usual 10% penalty. Not only that, the CARES Act has allowed individuals up to three years to pay the taxes owed on the withdrawal, softening what otherwise could be a major tax blow. The act also permits repayment of the withdrawal to the plan (if the plan allows it) or an IRA to avoid taxes.

The IRS followed up this legislation with some help of their own and released guidance broadening the number of people who can take coronavirus-related distributions from their 401(k) plans. The IRS guidance permits hardship withdrawals in the event of a spouse who has lost a job due to coronavirus or had a job offer rescinded due to the pandemic, and even includes any member of the individual’s household who has suffered furlough, reduced work hours, or the inability to work due to lack of child care.

In the case of retirement plan loans, the CARES Act eased account access through this channel too. Loans of 100% of vested account balances and up to $100,000 are permitted through September 30, 2020, and repayment of these loans and repayments on previous loans can both be suspended until 2021.

Staying the Course

With the usual obstacles to retirement savings leveled, you might have expected a substantial outflow of funds from qualified plans. That hasn’t happened. Neither has there been evidence of participants reducing their savings rate during the pandemic. Consider these findings:

- As of June 30, Fidelity reported that only 3% of eligible employees (711,000 individuals) had taken a CARES Act distribution. The median withdrawal amount was $4,800.

- T. Rowe Price reported that only 4.2% of eligible participants in plans with more than $25 million in assets took a coronavirus-related distribution. Fewer than 1% have taken out a COVID-19-related loan.

- Ascensus analyzed plans in its database of client plans with fewer than 500 participants and found that between March 1 and the end of May, 93% of retirement savers made no change to their savings rates.

(sources: Plan Adviser and SHRM)

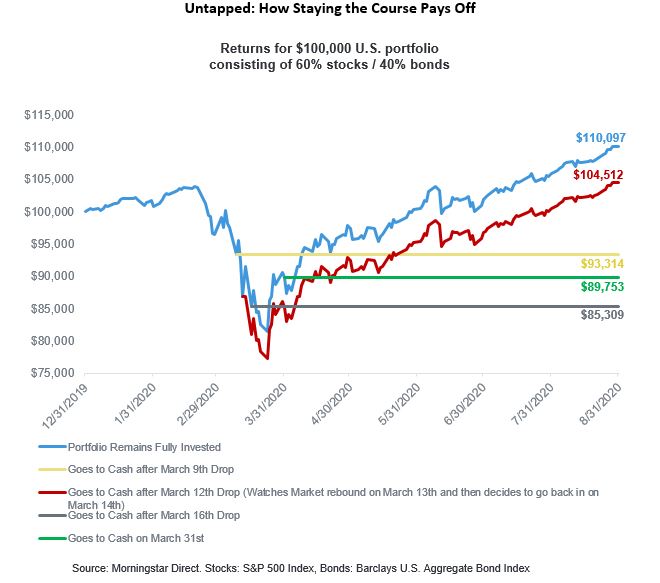

This restraint in accessing plan balances may owe to sound counsel from plan sponsors, the quick infusion of COVID-19 relief payments, the value of automatic savings contributions, or perhaps inertia, this time working in a saver’s favor. Whatever the reason, preserving the savings rate and leaving balances untouched has benefited participants by thousands of dollars as the chart below illustrates:

If a participant had a $100,000 balance at the end of December 31, 2019, and decided to withdraw their entire account balance as a CRD on March 31, the paper loss of over $10,000 would have become an actual loss. Even worse, those costly withdrawals, as a percent of account balances which dropped considerably in March, would not have enjoyed the wave of market gains in recent months. Conversely, an account with a value of $100,000 at year-end, left untouched, would have totaled just over $110,000 as of August 31, 2020. In other words, their withdrawal of their entire account balance ended up costing them a -18.5% loss through August 31.

Plan Sponsors Have Important News to Share

Plan Sponsors may want to applaud participants for their actions—or lack thereof, which have preserved their savings for a future time. And for those who had need of and accessed their savings due to financial hardship, there are important messages to share with them, including:

- Cautioning those who borrowed from their account to plan for repayment. If a loan defaults in 2021 or later, the enhancements (the waiver of the 10% penalty on distribution, ability to repay to the plan to avoid taxes) do not apply. The loan will be considered a withdrawal and subject to the 10% penalty and applicable taxes.

- Reminding those who took a withdrawal or loan that reduced balances may impact future plan balances and retirement readiness.

- Suggesting participants take another look at their investment strategies with consideration of current (withdrawal- or loan-reduced) account balances and future goals.

- Encouraging participants to increase their regular 401(k) contributions, especially if a loan or withdrawal has eroded their balances.

Finally, some plan sponsors will have the opportunity (actually, the obligation) to further expand retirement benefits to long-term, part-time employees.

Only three months before Congress passed the CARES Act, it passed the SECURE Act which extended retirement savings benefits to more Americans. A key upcoming change for plan sponsors is the requirement to expand eligibility to long-term, part-time employees, effective for plan years beginning on or after January 1, 2021. Under this rule, if a part-time employee has worked at least 500 hours in three consecutive years and is at least age 21 by the last day of the three consecutive year period, he or she must be offered the opportunity to make elective deferrals to the employer’s 401(k) plan. This is good news for long-term members of the gig economy.

What’s Next

It’s hard to know if the continuing pandemic will trigger additional draws on retirement savings, or if another coronavirus stimulus package will forestall that, but what seems clear—even during a pandemic, is that the decision to preserve retirement balances today leads to “untapped” potential and a greater opportunity for future financial security.

Highland Consulting Associates, Inc. was founded in 1993 by a small group of associates convinced that companies and individuals could be better served with integrity, impartiality, and stewardship. Today, Highland is 100% owned by a team of owner-associates galvanized around this promise: As your Investor Advocates®, we are Client First. Every Opportunity. Every Interaction.

Highland Consulting Associates, Inc. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer of solicitation for the sale or purchase of specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.