Posts by Rich Swanner, CPFA, QKA

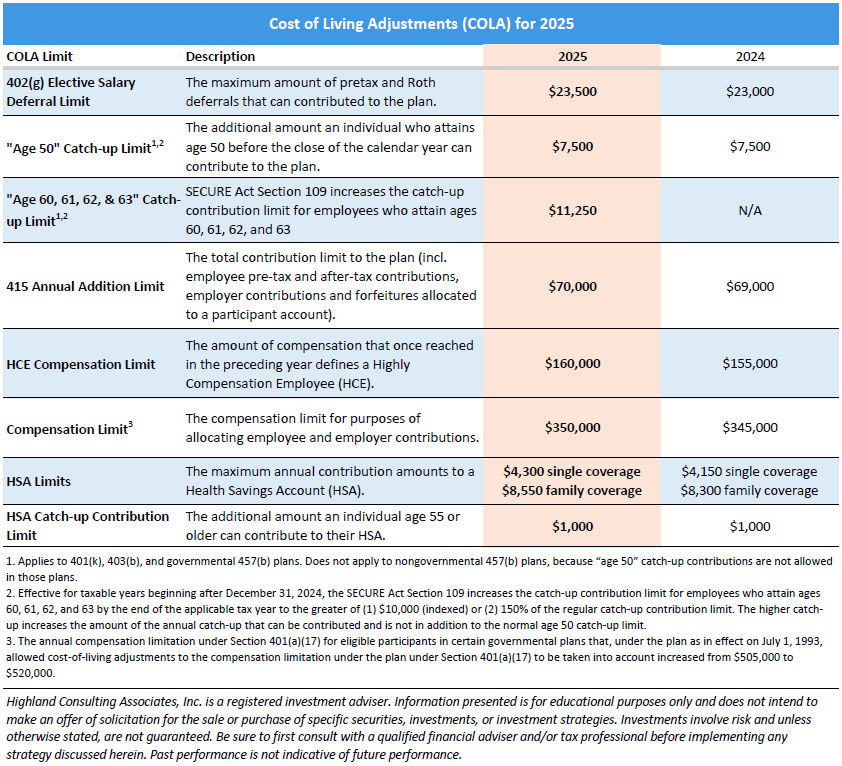

Cost of Living Adjustments 2025

The IRS recently released the Cost-of-Living Adjustments (COLA) for 2025 related to 401(k) and Health Saving Accounts. This table provides these and other limits that are of interest to many plan sponsors and their participants. If you would like more information please call us at 440-808-1500. Highland Consulting Associates, Inc. was founded in 1993 with the…

Read MoreThe 401(k) Forfeiture Kerfuffle and What it Means for 401(k) Plan Sponsors

photo credit: istock On February 21, 2024, yet another lawsuit was filed against a 401(k) plan sponsor over alleged misuse of forfeited retirement plan savings of terminated participants. This is the seventh lawsuit filed by the Pasadena-based law firm of Hayes Pawlenko LLP in federal district courts throughout California. This latest claim against Tetra Tech…

Read MoreInevitabilities: Death, Taxes…and Audits?

Benjamin Franklin is often quoted for having said there are two certainties in life: death and taxes. But, as mid and large plan sponsors of defined contribution (DC) plans can attest, their annual benefit plan audit is another certainty. And let’s not overlook the possibility of a regulatory audit. Regarding the latter, there’s been significant…

Read MoreFiduciary Training: Put Fear to Rest

Fear is a powerful motivating force. Advertisers are keenly aware of this and market products to spur consumers to action. FOMO, “fear of missing out,” is part of our modern-day lexicon. More obscure is liticaphobia, the irrational fear of lawsuits or being sued by someone. This fear is based on an unfounded sense that you…

Read MoreAgreement at the Eleventh Hour: SECURE Act 2.0 Signed into Law and What it Means for Your Plan

On December 29, 2022, President Biden signed into law the $1.7 trillion omnibus spending bill that included the Setting Every Community Up for Retirement (SECURE) Act 2.0. The act expands on provisions enacted with SECURE Act 1.0 in 2019. Three separate bills, one passed by the U.S. House of Representatives and two approved by the…

Read MoreFlipped Out over Fiduciary Liability Insurance?

In 2020, more than 200 class action lawsuits were filed under the Employee Retirement Income Security Act (ERISA). It was the high water mark for actions targeting the alleged mismanagement of 401(k) and 403(b) defined contribution retirement plans. A total of 125 such actions were filed in 2021, and subject experts expect another 75 to…

Read MoreHughes v. Northwestern: What Plan Sponsors Can Learn from the Supreme Court Ruling

ESG Investment Rules for ERISA Plans

While the Department of Labor rules keep changing, plan sponsors and fiduciaries should be familiar with this investment approach and what these rule changes could mean for retirement plans. As investor interest in sustainable investments has been increasing over the last decade, the trend has attracted heightened interest and action from regulatory and legislative bodies…

Read More