Flipped Out over Fiduciary Liability Insurance?

In 2020, more than 200 class action lawsuits were filed under the Employee Retirement Income Security Act (ERISA). It was the high water mark for actions targeting the alleged mismanagement of 401(k) and 403(b) defined contribution retirement plans. A total of 125 such actions were filed in 2021, and subject experts expect another 75 to 100 to be filed by the end of 2022.

The Cost of Plan Expense Mismanagement

The vast majority of these suits contend that plan sponsors and other plan fiduciaries breached their fiduciary duties by authorizing the plan to pay excessive fees for recordkeeping and/or investment management. (Other issues include fund underperformance.) Complaints in these fee litigation cases seek tens of millions of dollars in damages. In 2022, approved payouts over fee mismanagement have been large. As examples:

- In April 2022, the insurance carrier for Washington University’s retirement savings plan agreed to pay $7.5 million into a settlement fund benefitting participants, beneficiaries or alternate payees of the plan;

- In May 2022, New Jersey’s largest employer, RWJBarnabas Health, received preliminary court approval for a $1.75 million class settlement over claims of plan fee mismanagement and fiduciary disloyalty through a conflicted relationship with plan recordkeeper Fidelity; and

- In July 2022, a judge gave final approval for Costco to pay $5.1 million into a settlement fund to resolve fund and administrative fee mismanagement claims for its retirement plan.

Fee Mismanagement Lawsuits Not Limited to Large Plans

While these charges have been brought against multi-billion dollar plans, these actions may not stay limited to large plans. “It just keeps spreading. Exposure is metastasizing,” said Rhonda Prussack, Senior Vice President, Head of Fiduciary and Employment Practices Liability, Berkshire Hathaway Professional Insurance. “We’re seeing cases go more down market. Instead of just being big multibillion-dollar 401(k) plans, these cases are now spreading to smaller plans. Instead of being plans of big corporations, we’re seeing the spread to private companies and not-for-profit organizations.”

Fiduciary Liability Insurance Policies (FLIPs): Once Accessible and Affordable, May Be Less So Now

One way to protect plan sponsors from personal liability in such cases is fiduciary liability insurance. Introduced in the mid-1970s after ERISA was passed, it was designed to protect fiduciaries from personal liability imposed on them by ERISA for breaches of fiduciary duty even if inadvertent or unknown—including fee management failures. If plan fiduciaries are named in a lawsuit, a fiduciary liability policy will advance payment for defense bills. If the lawsuit is settled by plan fiduciaries, the insurer will contribute some, and sometimes all, of the settlement amount. Although ERISA does not legally require it, FLIPs may be the only coverage that can adequately protect plan sponsors and related fiduciaries, from corporate executives to payroll clerks.

It used to be that FLIPs were relatively easy to get and not overly expensive. That’s changing. Marsh McLennan Agency, an industry-leading business insurer has said that, “Insurance carriers have responded to the enhanced risk stemming from increased litigation and monetary settlements from fiduciary breaches by increasing policy rates (15–20%) and implementing stricter underwriting procedures … a growing number of carriers have implemented questionnaires tied to the administration of the retirement plan. These questionnaires can be confusing. Inaccurate or unclear responses can lead to even higher rate increases or renewal declination.”

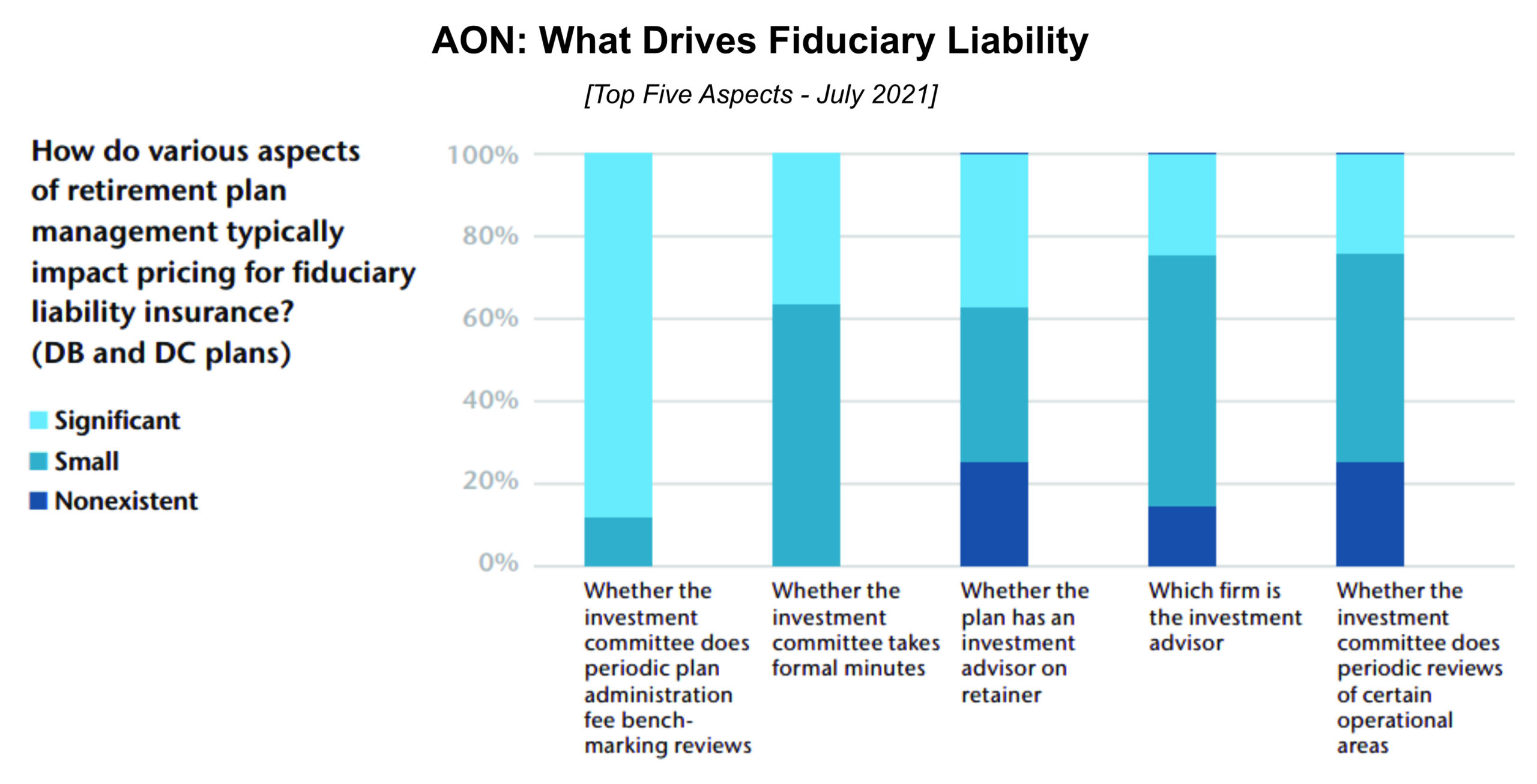

Aon surveyed 12 top carriers of fiduciary liability insurance to understand their views on the leading contributors of fiduciary risk within the control of ERISA plan fiduciaries. As you might expect, fiduciary liability insurers consider factors that influence fiduciary risk and incorporate those into their pricing. Aon reported that FLIP pricing varies greatly from a few thousand dollars per $1 million of coverage purchased to over $25,000 per $1 million in coverage.

The Aon research revealed that questions about fee levels and structures as well as processes for reviewing fees ranked as top drivers of fiduciary liability insurance premiums. “Specifically, 88% of respondents said that it was a ‘significant’ driver of insurance premiums whether the investment committee does periodic plan administration fee benchmarking reviews … Fees are clearly a key item to keep a close eye on and document that they are being managed well.”

Highland Can Help

Highland understands the importance of understanding and managing all expenses related to ERISA plans. As a co-fiduciary for every ERISA plan we serve, we regularly conduct fee audits and benchmarking reviews. We recognize that plan sponsors are required to know what fees they’re paying and whether they’re reasonable. Highland analyzes relevant data from our large client base, external resources, and ongoing search activity to measure and benchmark vendor fees in real time to help assess their reasonableness and value.

This process, which is just a part of our ongoing client-first service, can help you manage FLIP renewals and respond to escalating policy costs, but, more importantly, it can help you manage fiduciary risks themselves, so that lawsuits can be avoided altogether.

If you’d like to talk about plan expense management or fiduciary liability insurance, please contact Rich Swanner at 440.808.1500.

Highland Consulting Associates, Inc. was founded in 1993 with the conviction that companies and individuals could be better served with integrity, impartiality, and stewardship. Today, Highland is 100% owned by a team of owner-associates galvanized around this promise: As your Investor Advocates®, we are Client First. Every Opportunity. Every Interaction.

Highland Consulting Associates, Inc. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer of solicitation for the sale or purchase of specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.