The CARES Act: A Checklist of Considerations for Retirement Plan Sponsors

The Coronavirus pandemic overtook our daily lives and thriving economy like a violent storm. Almost as quickly, Congress reacted with legislation to lessen its impact on American workers by passing the Coronavirus Aid, Relief and Economic Security (CARES) Act. Providing nearly $2 trillion in economic relief, the Act included temporary provisions to help employees access their retirement funds if they’d been impacted directly by COVID-19. One of the benefits offered is an unmitigated win for those 70½ years old and older:

Waiver of RMDs (Required Minimum Distributions): RMDs for participants who have not otherwise made a distribution election are deferred until 2021.This preserves the account value of many participants whose RMD would have been a greater share of balances during the COVID-concurrent market decline. (Plan sponsors will already have noted that the December 2019 passage of the SECURE Act raises the age for RMDs from 70 ½ to 72.)

Far more complicated are the provisions for retirement plan distributions and loans. These seemingly beneficial provisions include:

Permitted CRDs (Coronavirus-Related Distributions): Participants can withdraw from account balances without penalty, up to the full account value or $100,000 (of employee and employer vested funds).

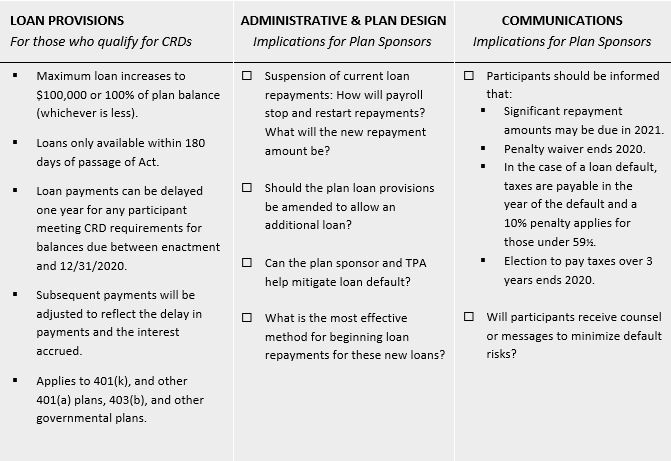

Increased Loan Allowances: Qualified individuals can borrow up to the lesser of $100,000 or 100% of their plan balance.

Deferment of loan repayments: Loan repayments can generally be delayed for up to one year. (But note: Third party administrator treatment of deferments and re-amortization vary. Check with your recordkeeper for specifics.) Easier access to retirement savings may be a lifeline to many workers, but the provisions come with some inherent risks. For example, a qualified employee who borrows a full $100,000 with a five-year repayment schedule at today’s rates, could be making payments of $1,800 a month. (Source: Forbes) This could be a burden in the best of times and nearly impossible if the participant or spouse becomes unemployed. A loan default then triggers the 10% early withdrawal penalty and taxation as income in the year of default. In a case like this, the lifeline becomes a millstone.

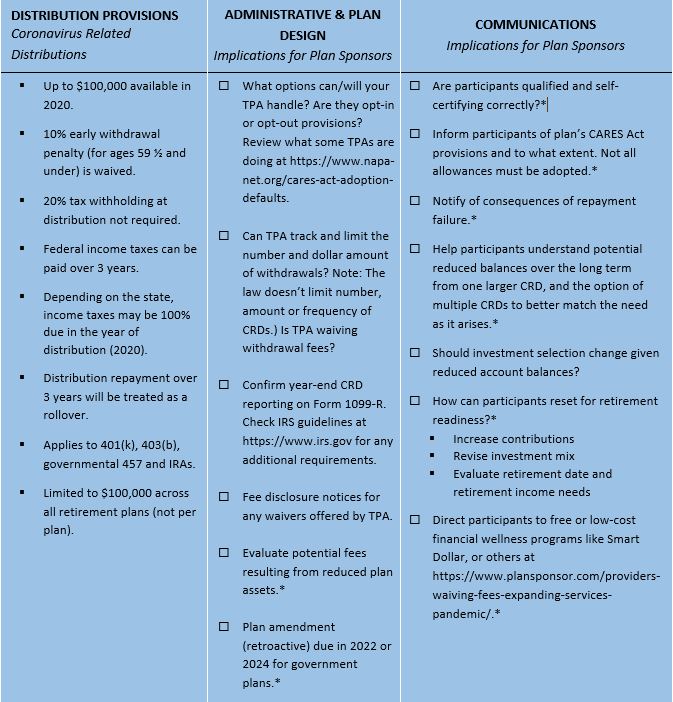

For plan sponsors and their recordkeepers, the CARES Act has created other, significant obligations and little time to prepare for them. We’ve identified some of the most consequential implications in the chart below, acknowledging that there are others to consider, and additional guidelines we expect the IRS to issue in coming weeks.

CARES Act Considerations for Plan Sponsors and their Third Party Administrators (TPAs)

The CARES Act, intended as a lifeline for millions of American workers impacted by the Coronavirus, may entangle plan sponsors in related administrative, reporting, and communications complexities. It’s worth noting that no sponsor is required to extend all of the CARES Act provisions. That is your option, and a settlor function. BUT, should you choose to offer these benefits, the administration and communication of them become a fiduciary matter, with all that entails.

As you consider these matters, please know that Highland stands beside you as a co-fiduciary. We commit to help you steward your plan and its assets as you guide your employees closer to retirement readiness—especially through the worst of public health and economic storms. Call us with any of your questions. We’re here to help.

Highland Consulting Associates, Inc. was founded in 1993 by a small group of associates convinced that companies and individuals could be better served with integrity, impartiality, and stewardship. Today, Highland is 100% owned by a team of 27 owner-associates galvanized around this promise: As your Investor Advocates®, we are Client First. Every Opportunity. Every Interaction.

Highland Consulting Associates, Inc. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer of solicitation for the sale or purchase of specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.