Insight

Impact Investing and Community Foundations Part 1

Impact Investing and the Governance Imperative: Why Community Foundations Need a New Decision-Making Framework Introduction Impact investing has become a defining topic for endowments and foundations, and for community foundations in particular, it represents something deeper than a new investment category. It is a governance evolution—one that requires clarity, alignment, and a shared understanding of…

Read MoreSix Key Focus Areas for Plan Sponsors in 2026 – A Clear-Eyed View

photo credit: Unsplash Retirement plan sponsors enter 2026 facing one of the most consequential years in recent ERISA history. Regulatory forces, market realities, participant expectations, and fiduciary exposure are all evolving simultaneously. SECURE 2.0 is moving from statute to operations. Cybersecurity threats continue to escalate. Retirement income solutions are transitioning from conceptual to operational. Investment…

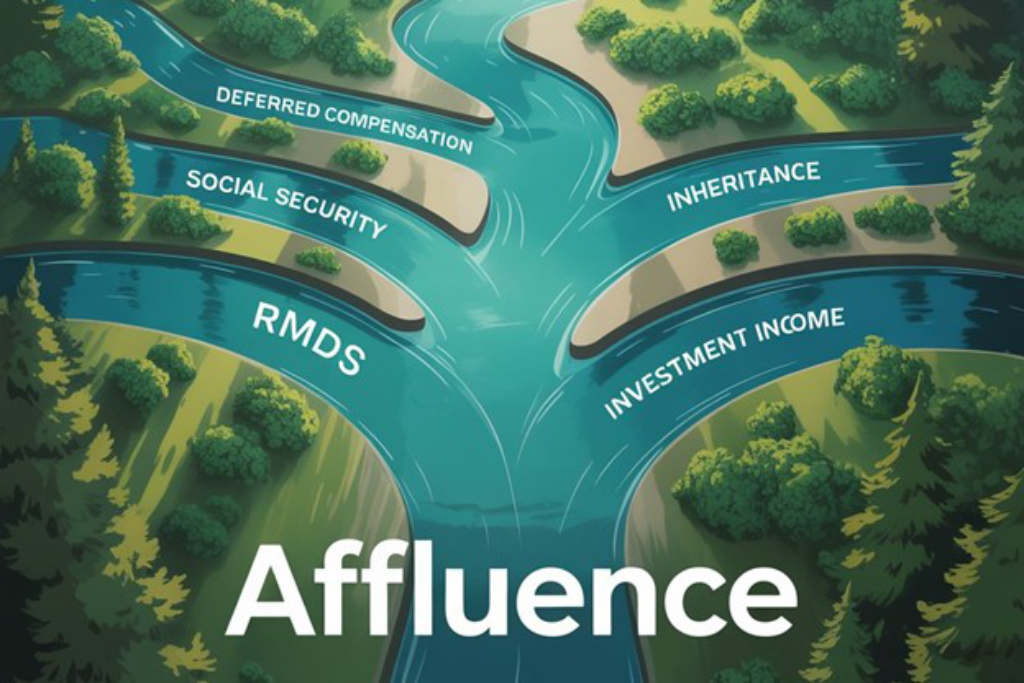

Read MoreFlowing Your Way to Affluence

photo credit: ideogram.ai When you hear the word “affluent,” especially in the context of a message from a financial advisor, it’s almost certain you think of its most common use: Affluent (adjective): having an abundance of goods or riches: wealthy. Did you know that affluent is also a noun? And, no—not one just used…

Read MoreSpeculative Assets in Retirement Plans: A Prudent Perspective

photo credit: Ideogram In our prior article, we examined the growing interest in private equity in 401(k) plans. That discussion, centered around illiquidity and fiduciary responsibility, provides important context for the next frontier: speculative assets. Recently, the Administration asked the Department of Labor (DOL) to further review their use in retirement plans. For plan sponsors,…

Read MoreRoth Catch-Up Contributions: The Long-Awaited Rules Have Finally Landed

photo credit: Ideogram After months of circling the regulatory runway, the IRS has released final regulations under the SECURE 2.0 Act, including long-anticipated guidance on Roth catch-up contributions. These rules provide much-needed clarity for employers preparing to implement the Roth catch-up provision in 2026. While the regulations officially apply to tax years beginning after December…

Read MoreIs Your 401(k) Ready for Private Assets? A Look Beyond the Promise

photo credit: Ideogram As the landscape of retirement savings continues to evolve, new proposals and potential opportunities emerge, promising enhanced returns and greater diversification for plan participants. Recently, discussions in Washington, D.C. have centered on the possibility of allowing private assets to become a more accessible component of 401(k) plan lineups, either as standalone options…

Read MoreSip and Savor: Enhancing Your Financial Strategy

In June, our Highland Family Wealth clients joined us for a delightful wine tasting at Gervasi Vineyard in Canton. The sun shined brightly over a beautiful day. After enjoying lunch, games, and a stroll through the property’s lush greenery, we walked into the Wine Cave for an educational tasting hosted by Gervasi’s team of sommeliers….

Read MoreThe E&F Advocate: Now a Law – The One Big Beautiful Bill Implications for Endowments & Foundations

The recently passed “One Big Beautiful Bill” (OBBB) represents the most consequential legislative package for U.S. endowments and foundations in over a decade. While sweeping in scope, its most significant implications for our community fall into three categories: tax reform, climate and infrastructure capital, and university governance provisions. Tax Code Overhaul: Pressures on Investment…

Read MoreGlide Path 2025: Does Heightened Market Volatility Require a Change in Strategy?

Photo credit: Unsplash Highland addressed this topic in 2023, reflecting on the previous year’s challenges and the looming threat of a recession. While the financial landscape has evolved, certain concerns persist. However, the dominant force shaping market volatility in 2025 has been policy shifts, primarily from the new administration, with less emphasis on monetary and…

Read MoreThe E&F Advocate: Impact of H.R.1 OBBBA on Endowments and Foundations

H.R.1 OBBBA will cause significant changes to endowment and foundation taxes in terms of a transition from flat to tiered tax rates, with various potential implications and impacts for universities and foundations. University Endowments The current flat 1.4% excise tax on net investment income for private colleges and universities would shift to a tiered…

Read More