Insight

The E&F Advocate: Key Takeaways on Proposed Endowment Tax Changes

photo credit: ideogram.ai The proposed endowment tax changes aim to increase the current 1.4% excise tax on net investment income of certain private colleges and universities to rates as high as 21% or more. Additionally, there are proposals to broaden the tax’s applicability by lowering the endowment assets per student threshold from $500,000 to…

Read MoreA Perspective on 2025 Tariffs

Photo credit: unsplash Why Tariffs to Restore Trade Balances Won’t Always Lead to a 1:1 Price Increase for Consumers, and Shouldn’t Throw Your Strategies Off Balance There’s a widespread assumption that tariffs—taxes on imported goods – automatically result in a direct, 1:1 price increase for consumers, meaning a 25% tariff would raise prices by 25%…

Read MoreThe E&F Advocate: A New Series from Highland Consulting Associates

In an ever-changing financial landscape, endowments and foundations (E&F) face numerous challenges and opportunities that require informed decision-making and strategic planning. As these organizations navigate complex issues surrounding governance, investment strategies, policy shifts, and tax implications, it’s crucial to stay ahead of emerging trends and evolving best practices. For this reason, we’re excited to launch…

Read MoreThe E&F Advocate: Five Pillars of Endowment Governance to Support Greater Liquidity, Transparency and Returns

Photo credit: Dreamstime The “Yale Model” of endowment investment strategy created by David Swenson, successful for decades, may be nearing retirement. What was developed during a time of falling interest rates, less asset class ubiquity, and diminished premiums for exotics, may be a far less tenable model in 2025. Models like Yale’s with their reliance…

Read MoreMake Your Own Luck: Navigating Pension Risks in a World of Terminations

Photo credit: Dreamstime The legal drama “Suits” follows the lives of ambitious lawyers at a prestigious New York City firm. If you’ve not seen it, at the heart of the series is Harvey Specter, a successful senior partner known for his arrogance and ruthless ambition. A master in the courtroom, Harvey outmaneuvers opponents with his…

Read MoreMore with Meaning: Aligning Your Life and Wealth

photo credit: Dreamstime As we turn the page to a new year, it’s natural to feel a mix of excitement, anticipation, and perhaps a bit of uncertainty. Are you looking forward to growth in your personal life, your relationships, or in the world around you? Or do you approach the future with caution, even concern,…

Read MoreThe Buffett Indicator

Photo credit: ID 336907040 © Yaroslaf | Dreamstime.com What do lizards, Blizzards, and underwear have in common? Warren Buffett and Berkshire Hathaway. And do the lizard and the DQ Blizzard (and Berkshire Hathaway holdings, in general) predict a freeze in an exceedingly hot investment market? Possibly. More on that later. The Omaha-based conglomerate counts GEICO, Dairy Queen, and Fruit of…

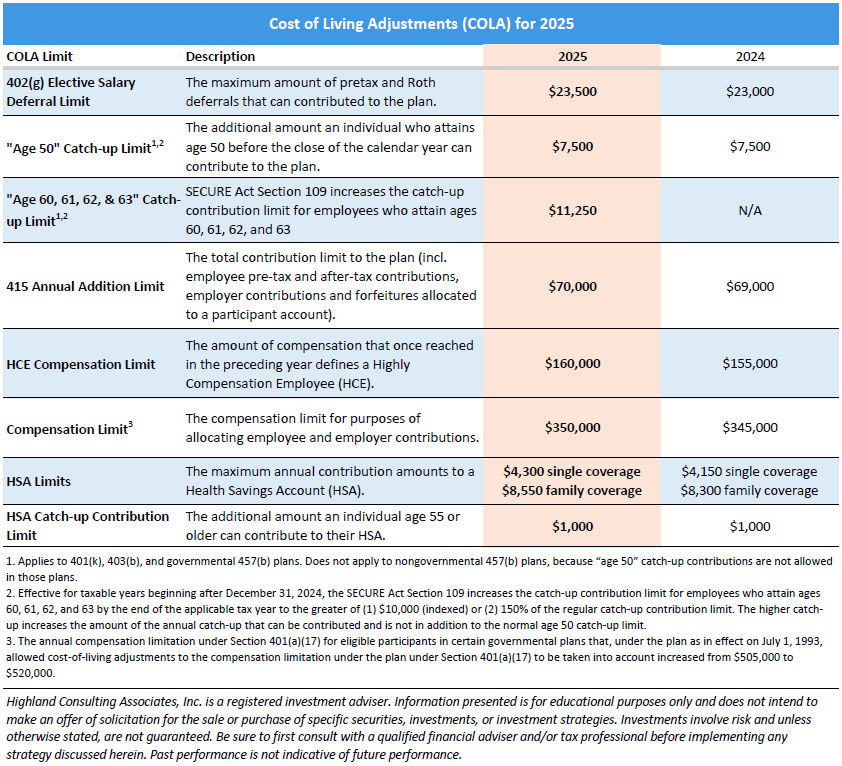

Read MoreCost of Living Adjustments 2025

The IRS recently released the Cost-of-Living Adjustments (COLA) for 2025 related to 401(k) and Health Saving Accounts. This table provides these and other limits that are of interest to many plan sponsors and their participants. If you would like more information please call us at 440-808-1500. Highland Consulting Associates, Inc. was founded in 1993 with the…

Read MoreThe Elusive 5%: Is It Making a Comeback?

photo credit: Pixabay For over a decade, we lived in a world of near-zero interest rates, making it incredibly challenging for plan sponsors and corporate asset managers to create low-risk portfolios yielding 5%. But as market dynamics shift, the landscape is changing, bringing new opportunities—and new decisions—to the forefront. The Challenge of the Last Decade…

Read MoreTimes Are Changing – Should You?

photo credit: Pixabay In recent years, cash has enjoyed a period of higher yields, thanks to recent central banks’ aggressive interest rate hikes aimed at curbing inflation. This has made cash and cash-equivalents—such as savings accounts, money market funds, and short-term government securities—more attractive than they have been in over a decade. However, with rate…

Read More