Clients Ask:

What do rising inflation and interest rates mean for fixed income investments and the economy?Are we seeing mixed signals?

Highland Responds

Our Highland clients have wanted to know how rising inflation and interest rate hikes impact fixed income investments and the broader economic picture. Are we seeing mixed signals? Possibly. And there may have been missed signals as well. Let’s consider:

- Benchmark Fed Rates: On June 15, 2022, the Federal Reserve hiked its benchmark interest rate by 75 basis points (.75%), the third hike this year and the largest since 1994. The move was intended to dampen the fastest pace of inflation we’ve seen in over 40 years.

- Surprising June 2022 Inflation Rate: The June inflation rate, a soaring 9.1%, exceeded even dire predictions. This high rate of price increases hasn’t been experienced since November 1981. This has generated speculation that the next rate hike could be as high as one hundred basis points. But who can say? At the June European Central Bank (ECB) Forum in Sintra, Portugal, even Federal Reserve Chairman Jerome Powell admitted, “I think we now understand better how little we understand about inflation.” It’s little wonder investors are confused. This helps to explain why Treasury yields, credit spreads and the yield curve are sending mixed signals.

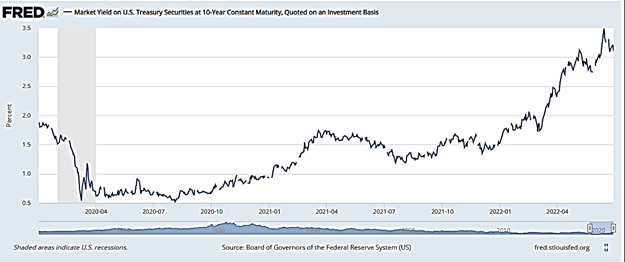

- Treasury Yields: We’ve also seen rates in the Treasury market increase sharply, with the benchmark 10-year note increasing by as much as 250 basis points since the COVID lows. The closing low on the 10-year U.S. Treasury bond occurred on March 9, 2020 at 0.54%. We are currently hovering around 3%.

- Credit Spreads: Over roughly the same period, credit spreads on investment grade bonds had hit a September 2021 low of 86 basis points. (Credit spreads are often an indicator of economic health. Widening spreads signal greater risk due to a weakening economic outlook.) While spreads have increased from that low to 159 basis points in July, the increase of only 73 basis points suggests that, at least to date, most of the negative fixed income performance can be attributed to higher interest rates and not wider spreads.

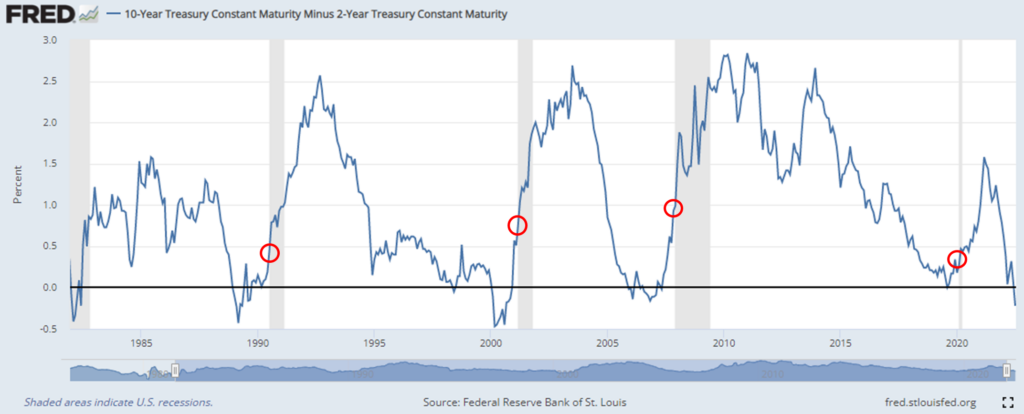

- The Yield Curve: The short end of the yield curve tends to follow central bank policy guidance, while the long end of the yield curve is a proxy for future growth and inflation expectations. So, a positively sloping yield curve signifies positive economic growth, which in turn encourages lenders to risk capital for longer periods of time. They demand a premium to lend longer as the prospect of being repaid decreases with time. This, then, creates an upwardly sloping curve. A steepening curve is generally associated with growth in a healthy economy. A flattening of the curve and beyond that, an inversion, signals economic weakness and investor worry.

We’ve seen the yield curve flattening since early 2021, and actually inverting in April, and again, briefly, in June. It has remained inverted for a third time since July 5. Historically, when the yield curve has inverted, a recession has followed. Also historically, only when the yield curve begins to steepen again is a recession likely to have begun. Central banks, fearing a slowdown, begin to cut short-term rates in order to minimize the damage from the upcoming recession, and the yield curve reestablishes its upward slope.

Taken together, all of this data often portends economic weakening. (In fact, the GDPNow forecast model of the Atlanta Federal Reserve is guiding toward a negative reading for second quarter 2022). However, this data could also be telling us something else.

Mixed Signals or Missed Signals?

What we could be observing is an indication of a policy error driven by the Federal Reserve’s insistence that inflation was transitory in 2021. This long-held view and failure to recognize building inflationary pressures, produced an inappropriate monetary policy response that allowed inflationary pressures to increase unchecked. The central bank may have missed the signal from the yield curve, and other indicators as well, that the economy was weakening as early as March 2021.

In summary, by acting late, the Federal Reserve fell behind the inflation cycle as the economy was showing initial signs of weakening. By acting late and now hiking aggressively into a slowdown, the Federal Reserve has likely exacerbated its initial policy error.

So, the next time you think of this year’s returns and grimace, remind yourself that it’s your loss-aversion bias talking. Instead, talk yourself into the long-term, strategic view Highland encourages and remember the gains you’ve experienced along the way.

Highland Can Help

If you have a question on fixed income investments, or perhaps a question on another topic of interest or concern, we at Highland are here to help. Just give us a call.

We remain Client First. Every Opportunity. Every Interaction.

Highland Consulting Associates, Inc. was founded in 1993 by a small group of associates convinced that companies and individuals could be better served with integrity, impartiality, and stewardship. Today, Highland is 100% owned by a team of owner-associates galvanized around this promise: As your Investor Advocates®, we are Client First. Every Opportunity. Every Interaction.

Highland Consulting Associates, Inc. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer of solicitation for the sale or purchase of specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.