Come Together: Nonprofits Pool Plans

Pooled plans are now for nonprofit organizations.

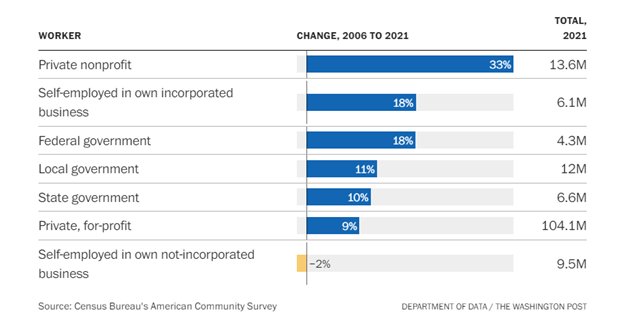

U.S. nonprofits account for 10% of the U.S. workforce, trailing only retail and manufacturing[i]. Not only that, but the sector has grown dramatically over the last 15 years[ii].

For nonprofits wanting to attract and retain employees (most often, employees who share a commitment to the nonprofit’s mission), offering a robust retirement plan option is an essential act of employee care. Following the December 2022 passage of the SECURE Act 2.0, offering that kind of plan has become more readily available.

Of the Act’s 90 provisions, one of the more notable for nonprofits is the opportunity to participate in multiple employer plans (MEPs) and, in particular, pooled employer plans (PEPs). Section 106 of the Act allows nonprofits to join together to potentially obtain more favorable retirement plan investments and more efficient and less expensive management services through participation in these plans.[iii]

Highland has long recognized the challenges that nonprofits have in offering a retirement benefit to their employees: cost, administration, education, or even how to start. Highland’s Joel Baker said, “With the passage of Secure 2.0 and consistent with Highland’s mission for the past 30 years, we can play an active part by helping employees access best-in-class, low-cost investment strategies so plan participants cannot simply retire, but retire well. The nonprofit community, by joining a pooled retirement plan, may be able to achieve economies of scale, reduce administrative efforts and reduce some fiduciary responsibility.”

Potential benefits of the new PEPs may include:

- Increased Participation. A 2019 national study found that 50 percent of responding nonprofits don’t offer any employee benefits.[iv] Not surprisingly, surveyed nonprofits said benefits weren’t offered because of administrative and regulatory complexity and expense. Pooled plans allow smaller organizations to join together to offer their employees an opportunity to participate in a retirement plan.

- Improved Investment Options. In the past, 403(b) plans have been criticized for offering lower quality investment options, carrying high expense burdens and reducing retirement savings growth. On the other hand, pooled plans can offer nonprofits the opportunity to access better investment options with lower fees.

- Reduced Administrative and Fiduciary Obligations. Nonprofits collaborating in a pooled retirement plan share the expenses related to plan administration and investment management, and reduce time spent managing the plan. Generally, 403(b) pooled plans operate with the fiduciary oversight of investment managers in ERISA 3(38) roles.

Many Benefits. One Caveat. While 403(b) PEPs can offer significant advantages, they do not release nonprofit employers from their fiduciary responsibilities, even with the appointment of an ERISA 3(38) Investment Manager. Employers must still fulfill their duties, but an advisor like Highland can help organizations navigate through these responsibilities.

Care for your Employees. Care for your Plan Investments.

Because of Secure Act 2.0 provisions, nonprofit employers have an additional option to consider to assist their employees down the path to a comfortable retirement. If you’d like more information on your current plan and on PEPs and how to evaluate or participate in one, Highland would be pleased to assist you. Contact Mike Grater, CFA, CPA, 440-808-1500.

[i] https://www.zippia.com/advice/nonprofit-statistics/

[ii] https://www.washingtonpost.com/business/2023/05/12/force-behind-americas-fast-growing-nonprofit-sector-more/

[iii] https://www.finance.senate.gov/imo/media/doc/Secure%202.0_Section%20by%20Section%20Summary%2012-19-22%20FINAL.pdf

[iv] https://www.workforgood.org/article/nonprofit-employee-benefits-benchmarked-how-competitive-are-yours-

Highland Consulting Associates, Inc. was founded in 1993 with the conviction that companies and individuals could be better served with integrity, impartiality, and stewardship. Today, Highland is 100% owned by a team of owner-associates galvanized around this promise: As your Investor Advocates®, we are Client First. Every Opportunity. Every Interaction.

Highland Consulting Associates, Inc. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer of solicitation for the sale or purchase of specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.