De-Risking Your Pension Plan: Is It Time to Assemble Your Team?

In 2022, MetLife commissioned a survey of 251 defined benefit (DB) plan sponsors and learned that 9 in 10 are considering a pension risk transfer (PRT), or a de-risking of their pension plan in the next 5 years.[i] Whether by lump-sum payouts to pension participants or through group annuity contracts with insurers, plan sponsors are seeking to relieve themselves of some or all of their obligations to pay guaranteed retirement income to plan participants. They’re also seeking to save significant amounts of money by reducing or eliminating some recurring costs of pension plans including, administrative costs (actuarial, investment management, audit); compliance costs (participant calculations and communication, disclosure requirements); and regulatory costs (PBGC premiums).

As more and more DB plans have closed to new participants or have stopped the accrual of additional benefits altogether, paying pension costs for former employees who no longer contribute to ongoing organization efforts can be hard to justify.

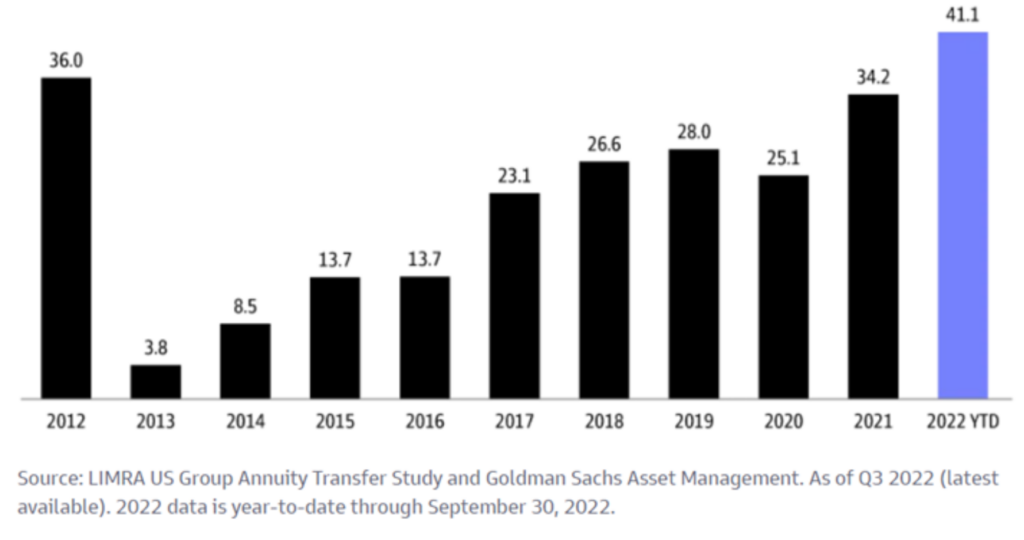

Broad-based improvement in funding status has prompted pension risk transfer activity. In fact, according to the Life Insurance Marketing and Research Association (LIMRA), 2022 was a record year for de-risking for both sponsors of large or “jumbo” plans and sponsors of smaller plans as well. In the first nine months of 2022, employers shrunk the size of their plans via annuity buyouts of $41 billion. This surpassed the previous annual record set in 2012 when buyouts totaled $36 billion.

The single largest buyout transaction was by IBM which completed the second-largest U.S. pension buyout transaction in history covering $16 billion in liabilities. That said, the sheer volume of transfers (which indicates interest of mid-size and smaller plans) was also record-setting at 562 buy-out contracts, 34% higher than the number of contracts sold in 2021, according to LIMRA reports[i].

De-Risking: It’s a Group Discussion

The recent issues of illiquidity among a small group of regional banks will almost certainly lead to tougher lending standards and a general curtailment in capital availability, but it should not be a distraction from plan sponsors’ objectives when it comes to managing pension risk. If shrinking or terminating a plan is a near- to mid-term consideration, gather the key players and start the conversations now, expecting that your plan de-risking could be a 3- to 18-month process. Here’s who and why:

- Your Actuary: Engage with your actuary on a regular basis to understand the de-risking opportunities, as some are fleeting. Understand the return on investment for each de-risking opportunity, as the initial costs can be intimidating.

- Your ERISA legal Team: Are there new compliance matters to consider? If recent legislation, new regulations or other guidance provided by the IRS, Department of Labor (DOL) or the Pension PBGC have occurred, you may need to make adjustments to your strategic plan.

- Your Pension Committee: Are there any sensitivities within the participant population that could slow down or even derail de-risking opportunities? How might a de-risking plan cause anxiety for employees and how might your communications provide assurance? When should you begin crafting the communications with affected participants?

- An Annuity Provider or Consultant: Working through your actuary or a third-party termination consultant will help to ensure the best results. While this process can be managed by internal staff, it can be challenging given the multitude of tasks and filings required, to meet the specific and often tight deadlines.

- Your Investment Advisor: Understand portfolio exposures. Is your portfolio designed to withstand short-term market volatility while contemplating any sort of de-risking activity? What changes need to made immediately to ensure a smooth process?

As a named fiduciary for all of our client plans, Highland always sits on your side of the table to help you evaluate the many options available as you consider de-risking. The time to gather your team around that table may be now. We can help you begin the conversation. Start by calling Mike Paolucci at 440.808.1500.

[i] https://www.metlife.com/retirement-and-income-solutions/insights/understanding-the-rise-of-pension-de-risking/

[ii] https://www.gsam.com/content/gsam/us/en/institutions/market-insights/gsam-insights/pension-solutions/2023/us-corporate-pension-review-and-preview-2023.html

[iii] https://www.metlife.com/retirement-and-income-solutions/insights/understanding-the-rise-of-pension-de-risking/

Highland Consulting Associates, Inc. was founded in 1993 with the conviction that companies and individuals could be better served with integrity, impartiality, and stewardship. Today, Highland is 100% owned by a team of owner-associates galvanized around this promise: As your Investor Advocates®, we are Client First. Every Opportunity. Every Interaction.

Highland Consulting Associates, Inc. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer of solicitation for the sale or purchase of specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.