Fiscal Dominance: How Pension Plan Sponsors May Have to Adapt

Photo credit: Pixabay

Buckets of federal spending are swamping conventional inflation fighting tools. What plan sponsors should know.

If you’ve ever tried bailing water out of a flooding basement with a bucket as your tool (as the water rises ever faster), you know something about fiscal dominance. The concept, or condition, is being talked about more often and it holds significant implications for consumers, investors, and pension plan sponsors.

The idea of fiscal dominance challenges the traditional view that monetary policy, controlled by central banks through interest rate and balance sheet adjustments, is the primary and most effective tool for managing inflation. Fiscal dominance suggests that when a country's debt and deficit levels become sufficiently high, monetary policy loses its effectiveness in curbing inflation. This happens because higher interest rates on a growing debt burden worsen the budget deficit in a self-reinforcing negative cycle.

Overwhelmed by Deficit Spending

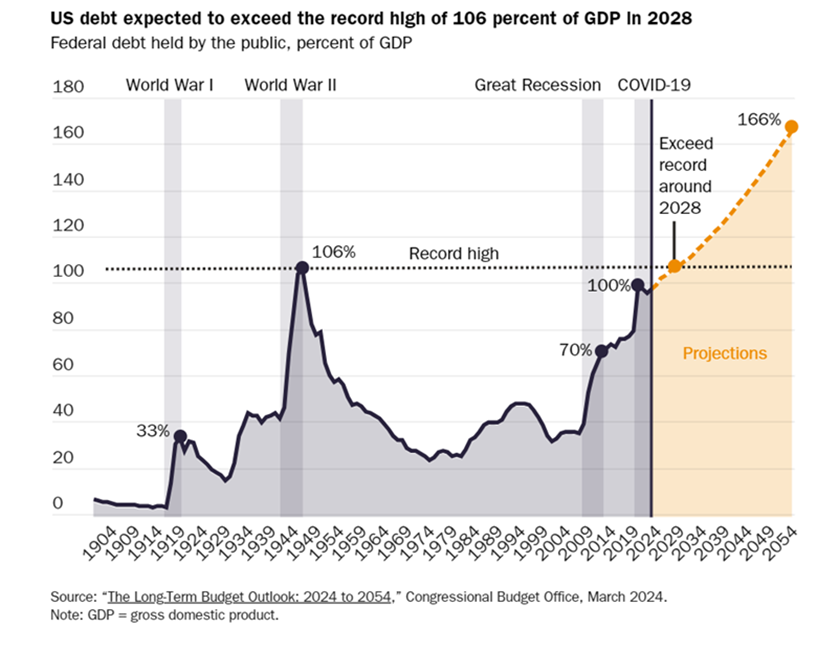

The Figure illustrates the rates of U.S. federal spending at levels not seen since WWII. Projections from the Congressional Budget Office show no expectations of reduced spending into the future.

And, why does this matter? During the past few years, as shown in the Figure, we have witnessed unprecedented levels of deficit-driven fiscal stimulus, beginning with the Great Recession/Global Financial Crisis and continuing beyond the response to the COVID-19 lockdowns. The onset of record government spending has overshadowed traditional bank lending as a driver of inflation. As a result, we observe a situation where increasing interest rates, typically a central bank tool used to curb inflation, may be ineffectual due to the dominance of loose, even excessive, fiscal policies and increasing deficit spending.

Credit tightening can’t overcome inflation because the deluge of federal deficit spending has not been stopped or even slowed. Outlays like the $61 billion by the Federal Deposit Insurance Corporation (FDIC) to facilitate the 2023 bank failures (discussed by Highland here) contribute to the increase. As more of our federal budget is allocated to debt service on unabating deficit spending, we risk inflation that stubbornly sticks and, more alarming, concern about our nation’s creditworthiness. One think tank put it this way, “The creation of new money for the sole purpose of covering government deficits introduces a competing use for currency. As more currency is created to cover government deficits, the new currency devalues existing units of currency. The resulting devaluation creates inflation.”[i] And that inflation, short of serious spending cuts, may become unrelenting.

Plan Sponsor Response to Fiscal Dominance and Stubborn Inflation

It behooves pension plan sponsors to understand the implications of fiscal dominance which point to a future with potentially higher interest rates and longer-lasting inflation, as well as increased economic volatility. In such circumstances, broad asset allocation strategies, particularly pension hedging portfolios, may need to be reexamined.

We suggest you review your plan strategies to:

- Monitor portfolio exposures frequently and adjust as market conditions change.

- Consider the desired level of hedging against the backdrop of interest rates that may not fall but remain where they are or even increase.

- Think and act opportunistically, when appropriate.

- Monitor lower-quality hedging exposures for any signs of stress.

We Can Help

Highland’s client-first approach causes us to be proactive in managing client portfolios. We carefully consider economic developments when constructing pension portfolios. We do so with particular attention to interest rates, which can significantly impact funded status volatility if not properly hedged.

We believe that staying well-informed, drawing on historical knowledge, and embracing a diversified and adaptable investment strategy are crucial for successfully navigating the complexities of today's economic environment.

As trusted advisors, we are duty-bound to recognize emerging trends and to respond to changing economic conditions on our clients’ behalf. Fiscal dominance may hinder conventional inflation-limiting tools, but with a thoughtful investment strategy, investors can adapt to challenges and capitalize on long-term opportunities in their pension programs—even if the challenge is federal spending by the buckets. If you’d like to talk further about your fiduciary responsibilities and how Highland can support you, contact Mike Paolucci, mpaolucci@highlandusa.net or 440-808-1500.

[i] heritage.org/budget-and-spending/report/the-road-inflation-how-unprecedented-federal-spending-spree-created

Highland Consulting Associates, Inc. was founded in 1993 with the conviction that companies and individuals could be better served with integrity, impartiality, and stewardship. Today, Highland is 100% owned by a team of owner-associates galvanized around this promise: As your Investor Advocates®, we are Client First. Every Opportunity. Every Interaction.

Highland Consulting Associates, Inc. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer of solicitation for the sale or purchase of specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.