Posts Tagged ‘defined benefit plan’

The Power of the PENsion: Reality and Resolutions – Guaranteed Retirement Income

photo credit Unsplash The Reality Americans have experienced in recent years: a worldwide pandemic, inflation, interest rate increases and geopolitical issues. There is a general feeling of unease. Add to that baseline the anxiety that workers report (up 33% in 2023[i]) concern about their jobs, their earnings, and their future financial security. According to a…

Read MoreThe Power of the PENsion: Have We Stuck the Landing? (Or are we skating on thin ice?)

Earlier this month, the Federal Open Markets Committee (FOMC) unanimously agreed to hold the key federal funds rate in a target range of 5.25% to 5.5%. This short-term benchmark rate has been held steady since July 2023. With the decision to leave the rate unchanged, it might have seemed we’d stuck the landing—the economy’s soft landing…

Read MoreThe Power of the PENsion: Count the Cost of Offering a Pension Plan

Comprehensive analysis of your plan may show the cost to be well worth your employees’ benefit What is the cost of providing a defined benefit pension plan? Beyond employer contributions, when determining costs, we consider custody, asset management, and consulting fees. These fees vary depending on the management of the plan and whether it is…

Read MoreThe Power of the PENsion: Labor Day and the Pension Plan

Pension Plans may be declining in numbers, but for millions of workers they are an essential retirement benefit with a history that is tied to Labor Day. Although summer may end officially on September 21, for most Americans, the season ends with Labor Day. The first Labor Day was celebrated in 1882. Far from marking…

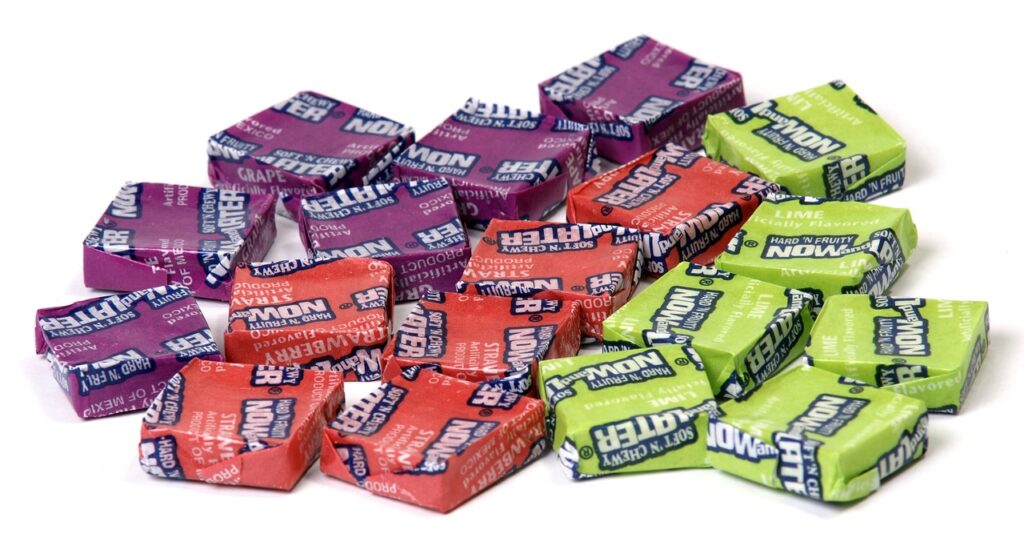

Read MoreThe Power of the PENsion: Contributions – Pay Now or Later?

It may be a Prime Day to consider your pension plan contributions. You can pay now or later and there are benefits and risks to each decision. Amazon’s annual Prime Day event ran for two days on July 11 and 12. Nothing raises consumer now-or-later decisions quite like it. For 2023, the number one item…

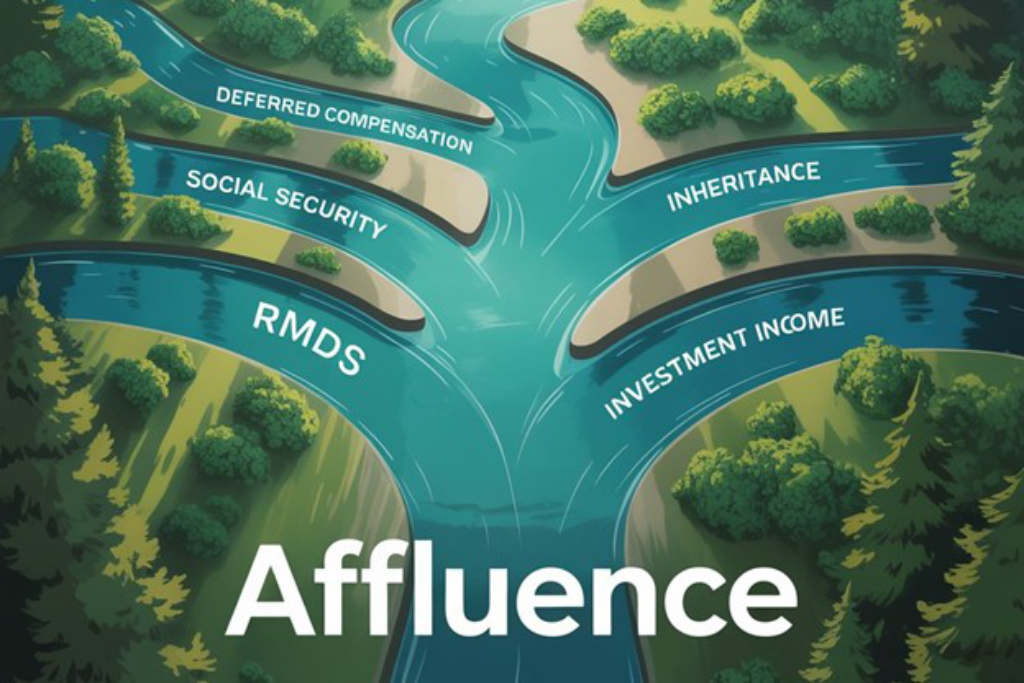

Read MoreThe Power of the PENsion

Private sector pension plans originated as early as 1875. By 1950, in our post-war manufacturing economy, more than 25% of the private sector workforce had a pension (or defined benefit) plan, offering employer-funded benefits with guaranteed payment (in lump-sum or in payment streams) at retirement. The advent of defined contribution plans like 401(k) plans, with…

Read MoreThrowing Darts in the Dark: Reasons to Review Your DB Plan Glide Path

For an employer, the ultimate goal of a defined benefit (DB) plan is to provide the retirement benefits promised to retirees. To accomplish this goal of funding those benefits and the related costs of providing them, an investment portfolio must generate sufficient returns—or a targeted rate of return (ROR). Asset allocation, or the practice of…

Read More