Times Are Changing – Should You?

photo credit: Pixabay

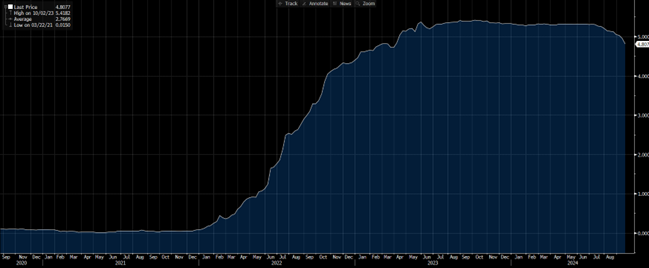

In recent years, cash has enjoyed a period of higher yields, thanks to recent central banks’ aggressive interest rate hikes aimed at curbing inflation. This has made cash and cash-equivalents—such as savings accounts, money market funds, and short-term government securities—more attractive than they have been in over a decade. However, with rate cuts upon us, it is crucial for investors to consider the broader implications of holding cash and to invest strategically.

The US Fed cut the target policy rate by 50 basis points last week. The Fed is confident inflation is coming down to their 2 percent target goal, and now they are shifting their attention to a weakening job market. When rate cuts occur, they likely lead to a decrease in the yields on cash and cash equivalents, reducing their attractiveness compared to other investments.

The higher yields on cash over the past 2 years made it an attractive option, but with rate cuts having begun, it is important to reassess your investment strategy. It is key to balance the benefits of current high yields with the risk of further declines and inflationary pressures.

It is also important and relevant to evaluate other fixed income opportunities. With rate cuts, the yields on new bond issuances and other fixed income securities are likely to be affected. Consider bonds with varying maturities or bond funds that can offer better returns in a declining rate environment.

Increasing duration in your fixed income portfolio can be a strategic move to capitalize on potential capital appreciation and enhanced yields. By aligning your portfolio with the expected decline in rates, you can be positioned to benefit from the resulting rise in bond prices and improve total returns. However, it is essential to carefully consider the associated risks and ensure that any changes align with your overall investment goals and risk tolerance.

US TREASUREY 3 MONTH BILL MONEY MARKET YIELD

Source: Bloomberg

Our Investor Advocates® at Highland would love to sit down with you to discuss how to implement a thoughtful strategy to optimize your fixed income investments in a changing interest rate environment.

Let’s talk about that next step. Contact Randy Fairfax at 440-808-1500.

Highland Consulting Associates, Inc. was founded in 1993 with the conviction that companies and individuals could be better served with integrity, impartiality, and stewardship. Today, Highland is 100% owned by a team of owner-associates galvanized around this promise: As your Investor Advocates®, we are Client First. Every Opportunity. Every Interaction.

Highland Consulting Associates, Inc. is a registered investment adviser. Information presented is for educational purposes only and is not intended to make an offer of solicitation for the sale or purchase of specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.