What’s Your Status? (One in two plan sponsors don’t know.)

Are retirement plan sponsors also fiduciaries? (Yes.)

What if the person involved with the retirement plan sits on a committee and doesn’t have day-to-day management responsibility? Is the person a fiduciary then? (The answer is still yes.)

It may seem obvious to some, but if you’re not altogether sure about your status as a fiduciary, you and defined contribution (DC) plan sponsors like you are in good company.

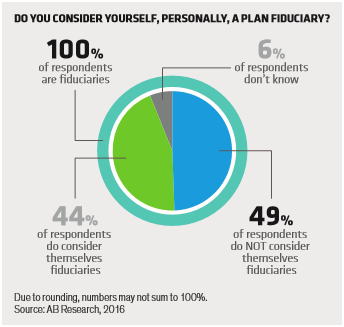

The investment management and research firm, AllianceBernstein (AB), surveyed over 1000 DC plan sponsors in 2016 and discovered that nearly half of those entrusted with fiduciary responsibilities were not aware of it. They did not consider themselves fiduciaries.

Despite the expectation that these plan sponsors would meet high standards of care, skill and prudence concerning plan assets and participants with the possibility of personal liability for breaches of responsibility, this group didn’t know what they had pledged to fulfil. (And note, this number is up from 37% of plan sponsors in 2014 and 30% in 2011.)

Role or Rule Confusion?

The research provides a clue to some of the role confusion. Those plan sponsors actively involved in the DC plan, in day-to-day decision making, acknowledged their obligations as a fiduciary two-thirds of the time. But among those who participated as committee members, either on an investment or administrative committee, only four in ten and two in ten, respectively, realized that they served collectively and individually as fiduciaries for the plan. An arms’ length involvement seems to lessen the understanding of their obligation.

Can we blame them? The Labor Department’s redefined rule on fiduciary obligations has kept a nation of retirement plan participants, sponsors, and providers guessing at their next move. What we had explained here just a year ago, has changed again.

The Obama-era regulation which proposed elevating all financial professionals (including broker-dealers) who work with retirement plans or provide retirement planning advice to a fiduciary level was to be phased in beginning April 2017. President Trump requested a review of the rule after taking office, delaying it until 2017 and phasing in certain rule exemptions through January 2018. Full implementation of all elements of the rule had been pushed back to July 2019.

But then on March 15 of this year, the New Orleans-based Fifth Circuit Court of Appeals overturned the rule on grounds of “unreasonableness.” And so, on March 19, 2018, the Labor Department announced, “pending further review, it will not be enforcing the 2016 fiduciary rule.”

But don’t blink (or think standards will be eased just yet). On April 18, 2018, the SEC released a 1,000-page proposal to beef up existing SEC requirements stopping just short of the 2016 DOL rule.

With the expressed hope of establishing standards to “foster greater clarity, certainty and efficiency with respect to broker-dealer standards of conduct,” the proposed SEC rule would hold advisers to a more stringent fiduciary standard than brokers. This, “in light of their different relationship types and models for providing advice,” according to the proposal. The proposal also suggests that broker-dealers would be permitted conflicts of interest when making a recommendation as long as those are disclosed. These include conflicts related to in-house products, fees and compensation.

And this is exactly what has The Home Depot in hot water and in the news.

The Home Depot Lawsuit: More Saving. Less Doing. More Fees.

In April 2018, two of Home Depot Inc.’s 401(k) plan participants sued plan executives alleging excessive fees and poor-performing investments representing a breach of their fiduciary duties under the Employee Retirement Income Security Act (ERISA). Home Depot is named in the class action suit seeking $140 million in damages on behalf of 200,000 current and former participants. Also named are Financial Engines and Alight Financial Advisors, both providers of investment advice to the plan.

The complaint charges that Home Depot had selected (and continued to offer) multiple sub-par funds for its 401(k) plan, and that it permitted the charging of unreasonable participant fees while ignoring a kickback scheme between an investment adviser and the plan’s recordkeeper. The complaint reads in part, “To add insult to injury, Home Depot condoned an arrangement in which Financial Engines kicked-back a portion of its fee to the plan’s recordkeeper. Although Home Depot replaced Financial Engines with Alight Financial Advisors in July 2017, Alight simply re-hired Financial Engines as a ‘sub-advisor.’”

David Sanford, counsel for the plaintiff and the proposed class, noted, “ERISA’s fiduciary standards are strict and exacting….Home Depot and the committees should be held to the highest standard as fiduciaries; instead, in this case, they fall below the lowest standard.” The case is a reminder that a lack of awareness of fiduciary obligations is no protection from litigation.

Who You Know Improves What You Know

Fiduciary standards require that retirement advisers act in the best interests of their clients, always putting client interests above the advisers’ own. They demand daylight on any potential conflict of interest, and the disclosure in clear dollar form of all fees and commissions related to retirement plan assets and retirement planning advice.

This is one reason why hiring a fee-only, independent adviser/fiduciary can help—and may have helped Home Depot. Advisers accept fiduciary responsibility, and by delegating some of this responsibility investment committee members limit their liability.

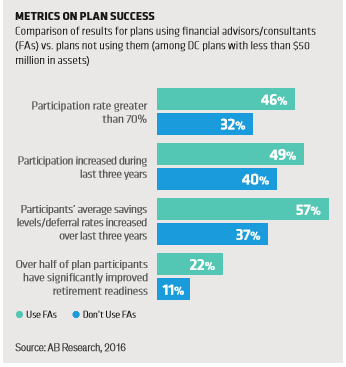

But limiting liability isn’t the only or even the best reason to work with an independent adviser. The AllianceBernstein research also determined that companies who enlisted the help of an investment consultant reported higher plan participation rates, increased savings levels and improved retirement readiness as well. As many as 49% of plans with an adviser witnessed higher participation rates, compared to 40% of plans without an adviser, and retirement readiness among adviser-assisted plans was “significantly improved” for twice as many participants (22% versus 11%) than plans without that guidance.

It is unlikely that Home Depot’s plan sponsors had any malicious intent in the governance of their 401(k) plan. Clients retaining Highland for ERISA plan advice have a genuine concern for their employees’ retirement readiness. At the same time, we recognize that our clients may involve other stakeholders in the management of their DC plans, whether 401(k) or 403(b) plans, who serve on the same kind of investment and administrative committees identified in the research.

That’s why as a part of Highland’s regular retainer services we conduct fiduciary and governance training for trustees and new board and/or committee members, even offering one-on-one training sessions to accommodate committee member schedules. And, as you should expect from an investment adviser, Highland also conducts in-depth analyses and benchmarking of fund performance and fund managers, and we routinely audit fees charged by custodians and record-keepers.

A qualified investment adviser will acknowledge the firm’s role as a fiduciary and undertake every effort to help plan sponsors understand their essential fiduciary role as well. Because “not knowing” offers no guarantee of protection under the law.

Let’s have a conversation

Highland has provided impartial, conflict free, and fee-only consulting services to our clients for 25 years. We would love to talk with you about your role as a fiduciary and plan sponsor and how we can help.