Clients Ask: What Is a Yield Curve Dis-inversion?

Photo credit: Pixabay

Clients Ask

- What is a Yield Curve Dis-inversion?

- Will Fed Rate Cuts Help a Slowing Economy?

- Or Will Fed Rate Cuts Re-ignite Inflation?

Highland Responds

After an extended period of inversion, the U.S. yield curve has recently undergone a significant change by dis-inverting. Our Highland clients have wanted to know what this dis-inversion portends. We’ve also been asked how the Fed’s recent rate cut of 50 basis points, may impact fixed income investments and the broader economic picture. We’re glad you’ve asked because these developments are crucial and worth understanding, especially for those keen on monitoring funding needs, investment strategies and macroeconomic trends.

Understanding Yield Curves: A Recession Predictor

Many investors are familiar with the concept of the yield curve and its significance in predicting recessions. We discussed the yield curve previously here. Historically, the yield curve has an impressive track record in forecasting economic downturns. The correlation is rooted in economic fundamentals: when the yield curve inverts, it typically indicates tight credit conditions due to high short-term interest rates. This scenario can hinder real economic activity, leading to weaker growth and lower inflation expectations reflected in the lower long-term yields.

Conversely, a steep yield curve, characterized by low short-term rates and higher long-term rates, suggests more access to credit as lenders feel good about the risk/reward tradeoff. This scenario often feeds into optimism for solid economic growth and inflation in the future. For this reason, serious macro investors should have a grasp on the yield curve, its slope and its movement.

The Recent Bull Steepening: A Late-Cycle Signal

The recent bull steepening of the yield curve has occurred during a late-cycle phase when nominal growth is slowing. In this context, the dis-inversion that follows an extended period of inversion serves as a vital macroeconomic signal indicating that growth may weaken further down the line.

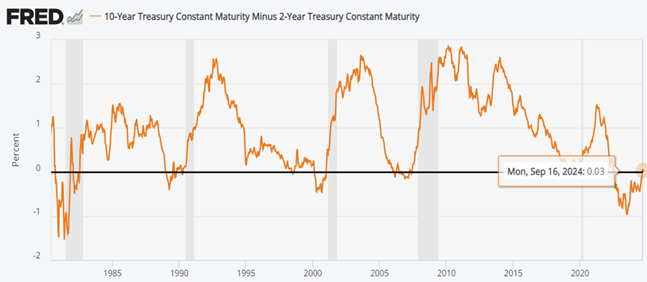

Investors should focus on dis-inversion rather than the initial inversion. Historical data illustrates that every recession since the 1970s began with a yield curve inversion but note that the time frame between the inversion and the onset of a recession varied significantly. The chart below illustrates how, in the early 1980s and the early 2000s, recessions (shown by the shaded lines) followed the initial inversion within as little as 12 months. By contrast, the 2008 recession took a more prolonged 27 months for the macroeconomic effects to fully manifest.

What’s Next? Monitoring Macro Lags

Currently, we find ourselves in a phase where the yield curve has been inverted for 27 months, and now it's in the process of dis-inverting as the job market shows signs of slowing. What’s critical to consider is that the effects of these macro lags can be especially prolonged in this cycle. The structure of the U.S. economy, characterized by fixed-rate mortgages and corporate borrowing, has somewhat insulated the private sector from the impacts of rising interest rates. Although these macro lags are lengthy, they have not vanished. Investors should remain vigilant and closely watch the indicators stemming from this recent dis-inversion.

What About the Fed’s September Rate Cut?

On September 19, the Federal Reserve made the move that had been hinted about in July. The central bank reduced rates by 50 basis points, the first cut in four years and the largest cut since the COVID-related responses shocked the economy in 2020. The question is whether this rate reduction is in response to inflation which appears to be stabilizing, or did the Fed cut rates because they sense the economy is already weakening and, even now, may be entering a recession?

If the Fed follows up in the next months with a similar reduction (and this has also been suggested) it may reveal a deeper concern about our economy’s strength. This cut and any that follow may signal an eagerness to reverse recessionary pressure that the Fed itself likely contributed to with its earlier, rapidly implemented and curve-inverting rate hikes.

What we do know and have written about, here, is that the effectiveness of the Fed’s policy decisions may be overwhelmed by the weight of continuing deficit spending. We expressed this concern when we wrote, “As more of our federal budget is allocated to debt service on unabating deficit spending, we risk inflation that stubbornly sticks and, more alarming, concern about our nation’s creditworthiness.” The markets may react positively to this "jumbo" rate cut, but only time will tell whether it stabilizes the economy or if additional loosening of financial conditions allows inflation to re-accelerate.

How Highland Can Help

As we continue to analyze the implications of this dis-inversion and the Fed’s rate moves and underlying expectations, please recognize that while some of these policy decisions might contribute to inflationary pressures (that had seemed to stabilize), sound investment practices can better protect your plan from these threats.

Count on us to keep you informed and prepared for winds of change that impact the economy and your plan as the weeks go by.

[i] https://fred.stlouisfed.org/graph/?g=1tWEs

Highland Consulting Associates, Inc. was founded in 1993 with the conviction that companies and individuals could be better served with integrity, impartiality, and stewardship. Today, Highland is 100% owned by a team of owner-associates galvanized around this promise: As your Investor Advocates®, we are Client First. Every Opportunity. Every Interaction.

Highland Consulting Associates, Inc. is a registered investment adviser. Information presented is for educational purposes only and is not intended to make an offer of solicitation for the sale or purchase of specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.