Posts by Mike Paolucci

Fiscal Dominance: How Pension Plan Sponsors May Have to Adapt

Photo credit: Pixabay Buckets of federal spending are swamping conventional inflation fighting tools. What plan sponsors should know. If you’ve ever tried bailing water out of a flooding basement with a bucket as your tool (as the water rises ever faster), you know something about fiscal dominance. The concept, or condition, is being talked about…

Read MoreThe Power of the PENsion: Am I a Plan Fiduciary? What Does That Mean?

Photo credit: iStock If your job responsibilities include involvement with an employee benefit plan, you may be a fiduciary, and so might others be who help manage the plan or its assets. Given that, it is important to know what a fiduciary is, who is deemed to be a fiduciary, and what the responsibilities are…

Read MoreSVB – A Year After the Bank’s Collapse

Photo Credit: Alexey Yarkin Short-sighted, Vulnerable, Broke Nearly a year ago, Silicon Valley Bank failed. On March 8, 2023, SVB announced a $1.75 billion capital raising effort, offering its common stock and depository shares. As the announcement moved through media outlets, the message heard was this: SVB is short on capital and it may not…

Read MoreThe Power of the PENsion: Reality and Resolutions – Guaranteed Retirement Income

photo credit Unsplash The Reality Americans have experienced in recent years: a worldwide pandemic, inflation, interest rate increases and geopolitical issues. There is a general feeling of unease. Add to that baseline the anxiety that workers report (up 33% in 2023[i]) concern about their jobs, their earnings, and their future financial security. According to a…

Read MoreThe Power of the PENsion: Have We Stuck the Landing? (Or are we skating on thin ice?)

Earlier this month, the Federal Open Markets Committee (FOMC) unanimously agreed to hold the key federal funds rate in a target range of 5.25% to 5.5%. This short-term benchmark rate has been held steady since July 2023. With the decision to leave the rate unchanged, it might have seemed we’d stuck the landing—the economy’s soft landing…

Read MoreThe Power of the PENsion: Count the Cost of Offering a Pension Plan

Comprehensive analysis of your plan may show the cost to be well worth your employees’ benefit What is the cost of providing a defined benefit pension plan? Beyond employer contributions, when determining costs, we consider custody, asset management, and consulting fees. These fees vary depending on the management of the plan and whether it is…

Read MoreThe Power of the PENsion: Labor Day and the Pension Plan

Pension Plans may be declining in numbers, but for millions of workers they are an essential retirement benefit with a history that is tied to Labor Day. Although summer may end officially on September 21, for most Americans, the season ends with Labor Day. The first Labor Day was celebrated in 1882. Far from marking…

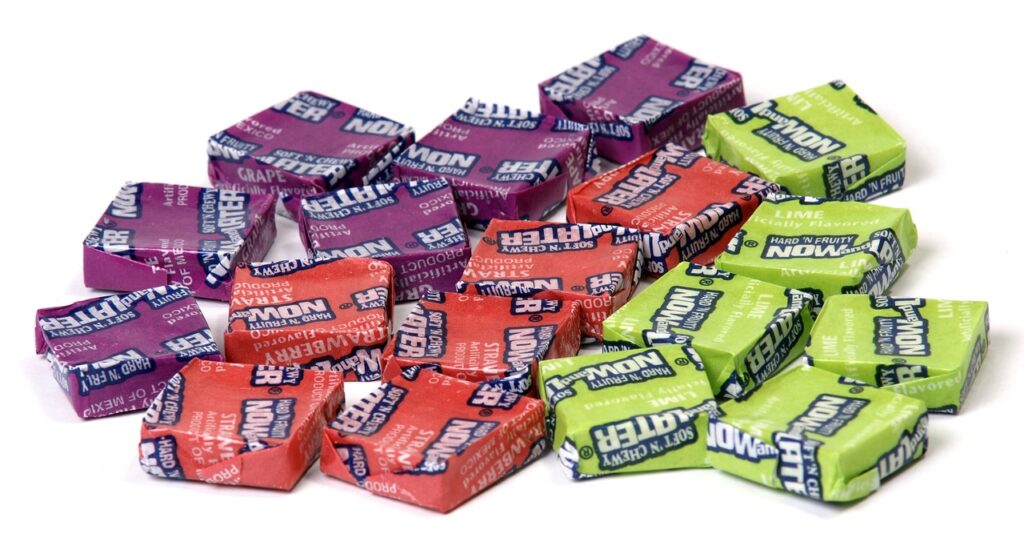

Read MoreThe Power of the PENsion: Contributions – Pay Now or Later?

It may be a Prime Day to consider your pension plan contributions. You can pay now or later and there are benefits and risks to each decision. Amazon’s annual Prime Day event ran for two days on July 11 and 12. Nothing raises consumer now-or-later decisions quite like it. For 2023, the number one item…

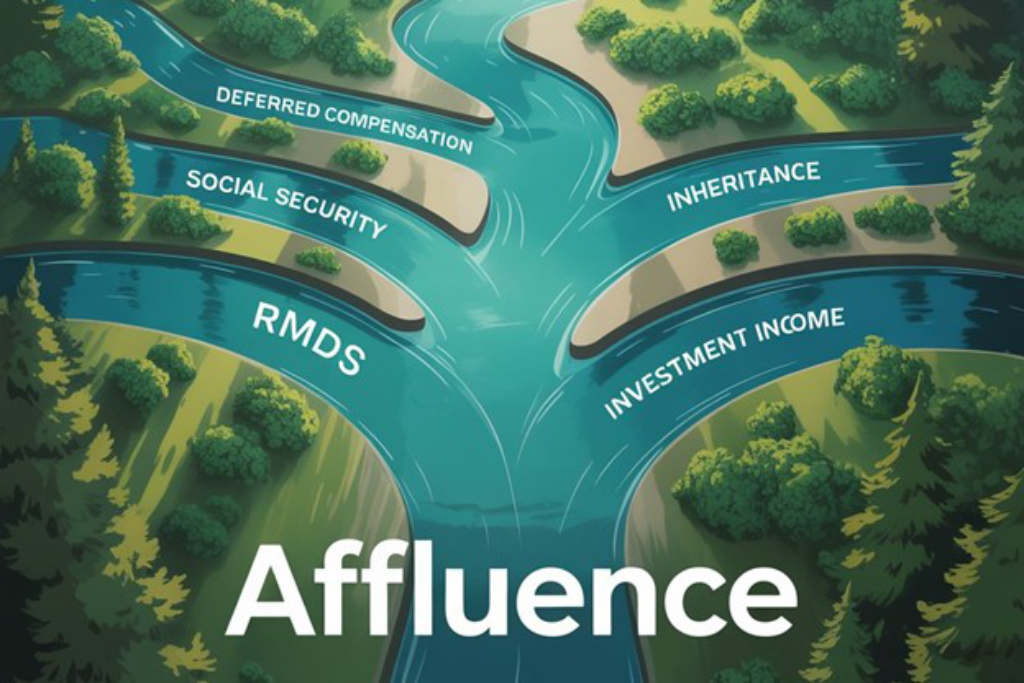

Read MoreThe Power of the PENsion

Private sector pension plans originated as early as 1875. By 1950, in our post-war manufacturing economy, more than 25% of the private sector workforce had a pension (or defined benefit) plan, offering employer-funded benefits with guaranteed payment (in lump-sum or in payment streams) at retirement. The advent of defined contribution plans like 401(k) plans, with…

Read MoreRFPs: Reframing For Productivity

Unlocking the Power of Unconventional Thinking in Your Next RFP. Most pension plan sponsors engage in a “request for proposal” (RFP) process on a periodic schedule to fulfill their fiduciary obligations. Importantly, the RFP process helps to gauge the value of provider services to the plan and the reasonableness of those associated fees. Very likely,…

Read More