The E&F Advocate: Five Pillars of Endowment Governance to Support Greater Liquidity, Transparency and Returns

Photo credit: Dreamstime The “Yale Model” of endowment investment strategy created by David Swenson, successful for decades, may be nearing retirement. What was developed during a time of falling interest rates, less asset class ubiquity, and diminished premiums for exotics, may be a far less tenable model in 2025. Models like Yale’s with their reliance…

Read MoreFebruary 2025

Summary Markets were mixed in February, as U.S. investors shunned equities for the safety of bonds. Outside of the U.S., markets shrugged off the uncertainty surrounding potential U.S. tariffs to generate modest gains. January CPI came in slightly above expectations, and geopolitics moved to the forefront again with questions on U.S. policy shifts in Ukraine…

Read MoreJanuary 2025

Summary Markets started 2025 on solid footing with major asset classes posting positive returns in January. Global equity markets moved higher and interest rate volatility was muted during the month. While markets closed January with an eye toward the impact of evolving trade policies related to President Trump’s tariff threats. Earlier gains prevailed against any…

Read MoreMake Your Own Luck: Navigating Pension Risks in a World of Terminations

Photo credit: Dreamstime The legal drama “Suits” follows the lives of ambitious lawyers at a prestigious New York City firm. If you’ve not seen it, at the heart of the series is Harvey Specter, a successful senior partner known for his arrogance and ruthless ambition. A master in the courtroom, Harvey outmaneuvers opponents with his…

Read MoreMore with Meaning: Aligning Your Life and Wealth

photo credit: Dreamstime As we turn the page to a new year, it’s natural to feel a mix of excitement, anticipation, and perhaps a bit of uncertainty. Are you looking forward to growth in your personal life, your relationships, or in the world around you? Or do you approach the future with caution, even concern,…

Read MoreDecember 2024

Summary Markets stumbled across the finish line to end 2024. Interest rates rose and stocks tumbled in December. The yield curve continued to steepen, and non-U.S. stocks held up better than domestic equities for the month. Traders shifted to more of a risk-off posture following some less-than-dovish commentary from the Federal Reserve Board early in…

Read MoreThe Buffett Indicator

Photo credit: ID 336907040 © Yaroslaf | Dreamstime.com What do lizards, Blizzards, and underwear have in common? Warren Buffett and Berkshire Hathaway. And do the lizard and the DQ Blizzard (and Berkshire Hathaway holdings, in general) predict a freeze in an exceedingly hot investment market? Possibly. More on that later. The Omaha-based conglomerate counts GEICO, Dairy Queen, and Fruit of…

Read MoreNovember 2024

Summary U.S. stocks rallied in November as investors responded favorably to a clear-cut presidential election result. Interest rates increased on the news of a President Trump return to the White House before easing a bit by month end. The Federal Reserve cut rates by 25 basis points, reiterating a commitment to a gradual easing of…

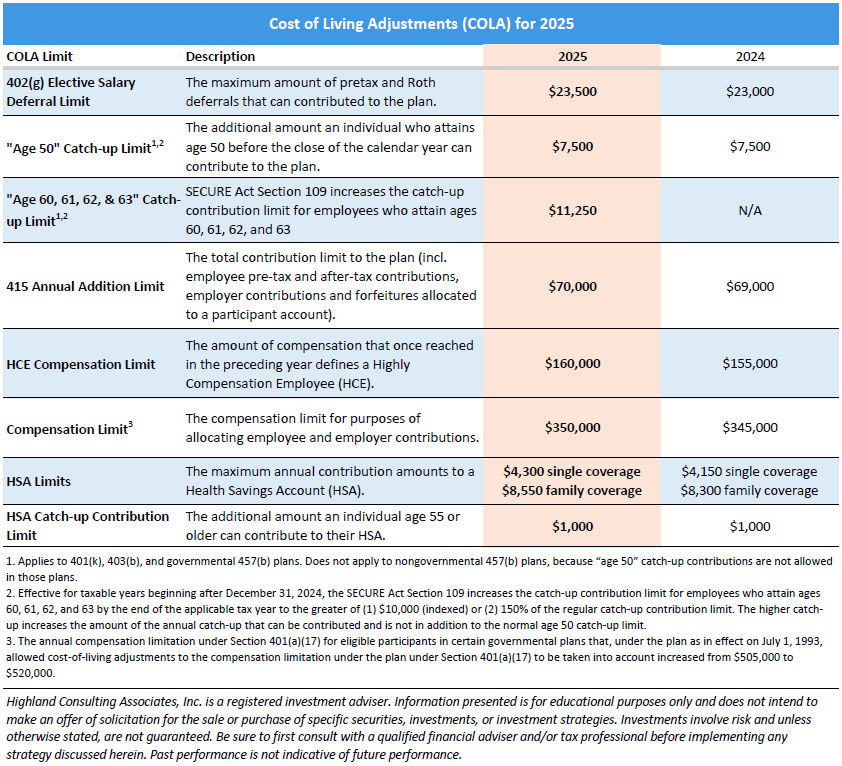

Read MoreCost of Living Adjustments 2025

The IRS recently released the Cost-of-Living Adjustments (COLA) for 2025 related to 401(k) and Health Saving Accounts. This table provides these and other limits that are of interest to many plan sponsors and their participants. If you would like more information please call us at 440-808-1500. Highland Consulting Associates, Inc. was founded in 1993 with the…

Read MoreOctober 2024

Summary Markets gave back gains in October with most major indexes finishing the month in the red. Bond yields moved higher as September’s rate cut euphoria wore off in emphatic fashion. Stocks tumbled with markets keying in on a toss-up U.S. presidential election. U.S. GDP growth slowed in the third quarter but remained respectable at…

Read More