The Power of the PENsion: Count the Cost of Offering a Pension Plan

Comprehensive analysis of your plan may show the cost to be well worth your employees’ benefit What is the cost of providing a defined benefit pension plan? Beyond employer contributions, when determining costs, we consider custody, asset management, and consulting fees. These fees vary depending on the management of the plan and whether it is…

Read MoreInevitabilities: Death, Taxes…and Audits?

Benjamin Franklin is often quoted for having said there are two certainties in life: death and taxes. But, as mid and large plan sponsors of defined contribution (DC) plans can attest, their annual benefit plan audit is another certainty. And let’s not overlook the possibility of a regulatory audit. Regarding the latter, there’s been significant…

Read MoreAugust 2023

Summary Markets seemed to wilt in the summer heat of August before staging a small rally at month-end to pare earlier losses. On August 1st, Fitch downgraded its rating for U.S. government debt from AAA to AA+, sparking an equity and interest rate sell-off that persisted for three weeks. Later in the month, encouraging economic…

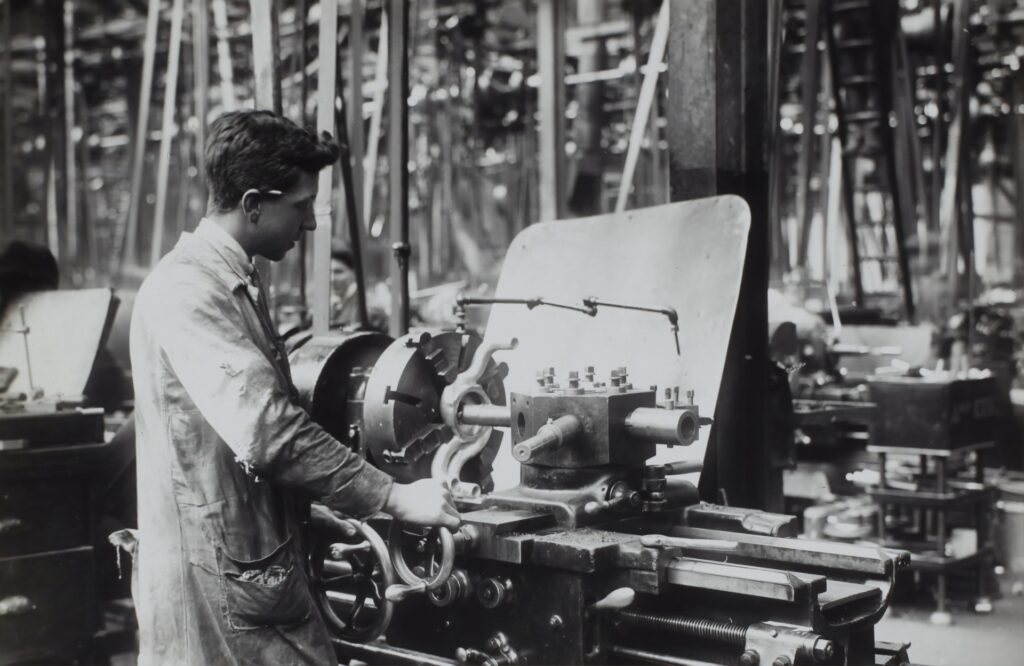

Read MoreThe Power of the PENsion: Labor Day and the Pension Plan

Pension Plans may be declining in numbers, but for millions of workers they are an essential retirement benefit with a history that is tied to Labor Day. Although summer may end officially on September 21, for most Americans, the season ends with Labor Day. The first Labor Day was celebrated in 1882. Far from marking…

Read MoreGuardians of Finance with Matt McLaughlin and Rich Veres

In this episode of Guardians of Finance, sponsored by the CFA Society Cleveland, Rich Veres, CFA, Co-founder & President of Highland Consulting Associates chats with Matt McLaughlin on Rich’s journey from Akron to founding Highland, some of the changes he’s seen in investment consulting, and how balancing business and family life is important to Rich….

Read MoreCome Together: Nonprofits Pool Plans

Pooled plans are now for nonprofit organizations. U.S. nonprofits account for 10% of the U.S. workforce, trailing only retail and manufacturing[i]. Not only that, but the sector has grown dramatically over the last 15 years[ii]. For nonprofits wanting to attract and retain employees (most often, employees who share a commitment to the nonprofit’s mission), offering…

Read MoreJuly 2023

Summary Stocks moved higher in July, and interest rates edged upward. While much of the country dealt with scorching temperatures, inflation continued to cool; June’s CPI of 3% marked a new low off 2022’s peak. Consumer confidence and the labor market both continued to improve. Following a pause in June, the Fed hiked the fund…

Read MoreThe Power of the PENsion: Contributions – Pay Now or Later?

It may be a Prime Day to consider your pension plan contributions. You can pay now or later and there are benefits and risks to each decision. Amazon’s annual Prime Day event ran for two days on July 11 and 12. Nothing raises consumer now-or-later decisions quite like it. For 2023, the number one item…

Read MoreJune 2023

Summary Global equity markets moved higher in June. Boosted by resilient consumer spending and technology sectors, U.S. stocks led the way, as equities continued to rebound from 2022’s losses. Inflation cooled to 4% through May, its lowest level in over two years, prompting the Federal Reserve to pause in their tightening cycle, and ending a…

Read MoreThe Power of the PENsion

Private sector pension plans originated as early as 1875. By 1950, in our post-war manufacturing economy, more than 25% of the private sector workforce had a pension (or defined benefit) plan, offering employer-funded benefits with guaranteed payment (in lump-sum or in payment streams) at retirement. The advent of defined contribution plans like 401(k) plans, with…

Read More