The Buffett Indicator

Photo credit: ID 336907040 © Yaroslaf | Dreamstime.com

What do lizards, Blizzards, and underwear have in common? Warren Buffett and Berkshire Hathaway.

And do the lizard and the DQ Blizzard (and Berkshire Hathaway holdings, in general) predict a freeze in an exceedingly hot investment market? Possibly. More on that later.

The Omaha-based conglomerate counts GEICO, Dairy Queen, and Fruit of the Loom among its wholly owned subsidiaries. The investment firm owns, in whole or in part, 40 companies. What began in 1962 with an investment in a declining textile business named Berkshire Hathaway, Buffett has woven into the foremost investment firm that attracts an arena full of investors to its annual shareholder meetings, a.k.a., Woodstock for Capitalists.

Beginning with Integrity: The Buffett Partnership

Buffett gained renown with Berkshire Hathaway but his investment philosophies—and his integrity – pre-date this more modern marvel. In 1956, at 26 years old, Buffett launched his first fund, Buffett Partnership, Ltd. with seven limited partners including his mother, sister, father- and brother-in-law, a college roommate, and a lawyer. He began with $105,100 and imposed no management fees. Buffett took 25% of the gains greater than 6%, and personally absorbed a percentage of any losses. The partnership generated a compound growth rate of about 30%. Just six years after its founding, Buffett became a millionaire. Seven years later, he ended the partnership.

What Ends a Good Thing? Something Better

The market boom of the 1960s made finding undervalued stocks, Buffett's specialty, increasingly difficult and time-consuming. In addition, his method of investing was not scalable for managing a large pool of capital. In essence, Buffett closed his partnership not because his strategy was failing, but because he recognized the need to adapt to changing market conditions and pursue a more scalable investment approach.

When Buffett liquidated the partnership, he named his new company after one of the liquidated underlying offerings, Berkshire Hathaway, offering cash or shares to existing investors. He also recommended his trusted friend, Bill Ruane, as a new manager of their assets. Buffett acted in accord with his oft-repeated advice: “In looking for people to hire, you look for three qualities: integrity, intelligence, and energy. And if they don't have the first, the other two will kill you.”

In closing his partnership, Buffett concentrated his energies on building Berkshire Hathaway as, primarily, an insurance company where the premiums he collects from policy holders get invested before having to pay out claims. Today it is known as an investment powerhouse. This strategic decision to close the partnership highlighted his adaptability, based on rational responses, and unwavering commitment to delivering long-term value to investors.

What Will End Today’s Hot Markets? Do Berkshire Hathaway, Lizards, and Blizzards Forecast a Freeze?

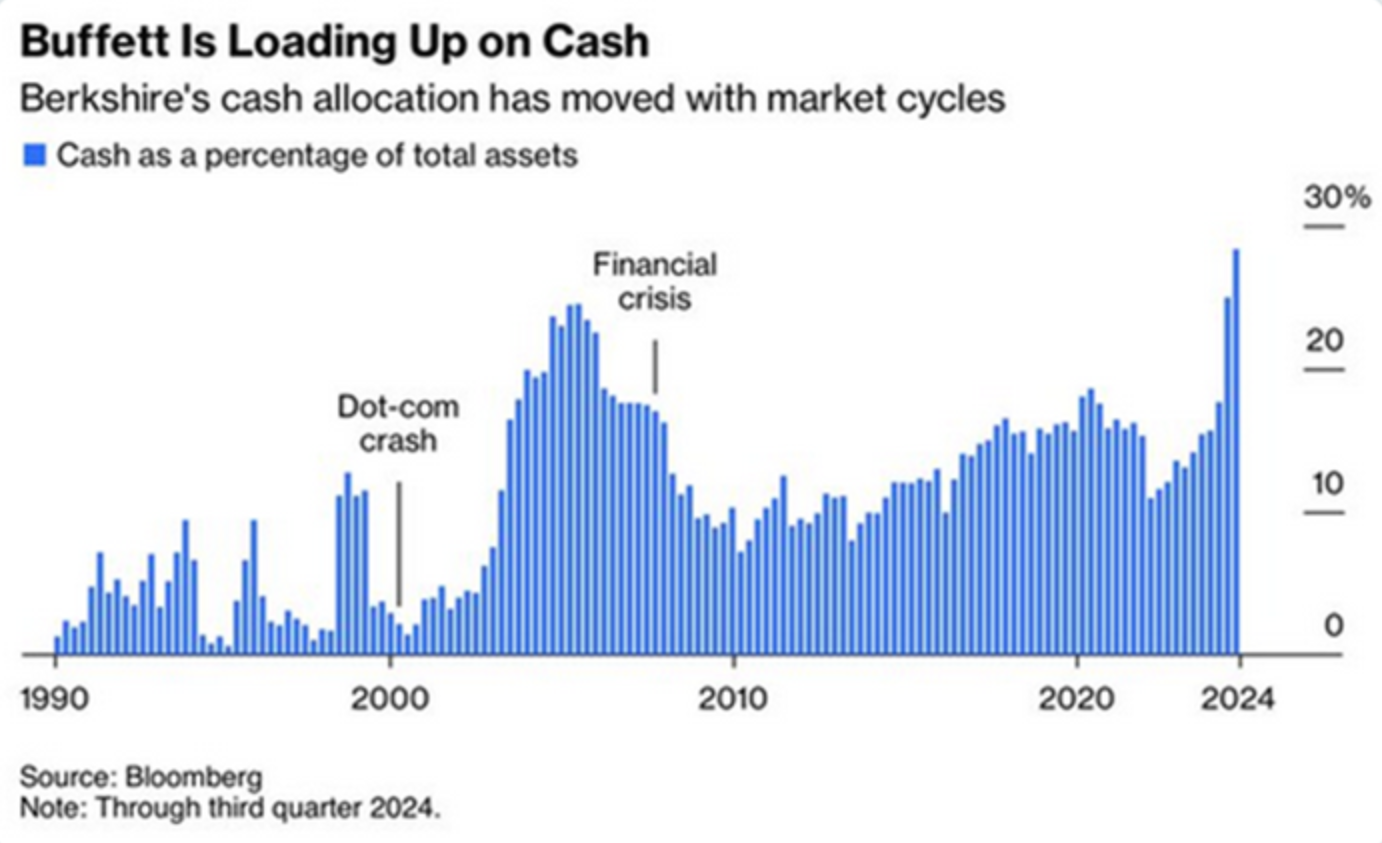

Buffett's Berkshire Hathaway has been accumulating a significant amount of cash, especially recently. This cash hoard has reached $325 billion, or nearly 30% of total assets (a new high) and is seen by some as an early warning signal for the market. Note how Buffet’s cash holdings increased before the dot-com and global financial crises. The current level of cash is comparable to these previous peaks, suggesting that Buffett might not be able to find quality investments for inclusion in his portfolio.

Berkshire Hathaway's significant cash holdings could be attributed to various factors, including concerns about market uncertainty and the lack of attractive investment opportunities that meet Buffett's value investing criteria. This substantial cash reserve may also be strategically positioned as "dry powder" to capitalize on potential opportunities that may arise during a market downturn. However, while this cash accumulation is notable, it does not necessarily signal an imminent market downturn. Buffett has historically held substantial cash reserves for extended periods and possesses a long-term investment horizon. Moreover, his investment decisions may be informed by unique insights that are not readily apparent to the broader market.

Do You See What I See?

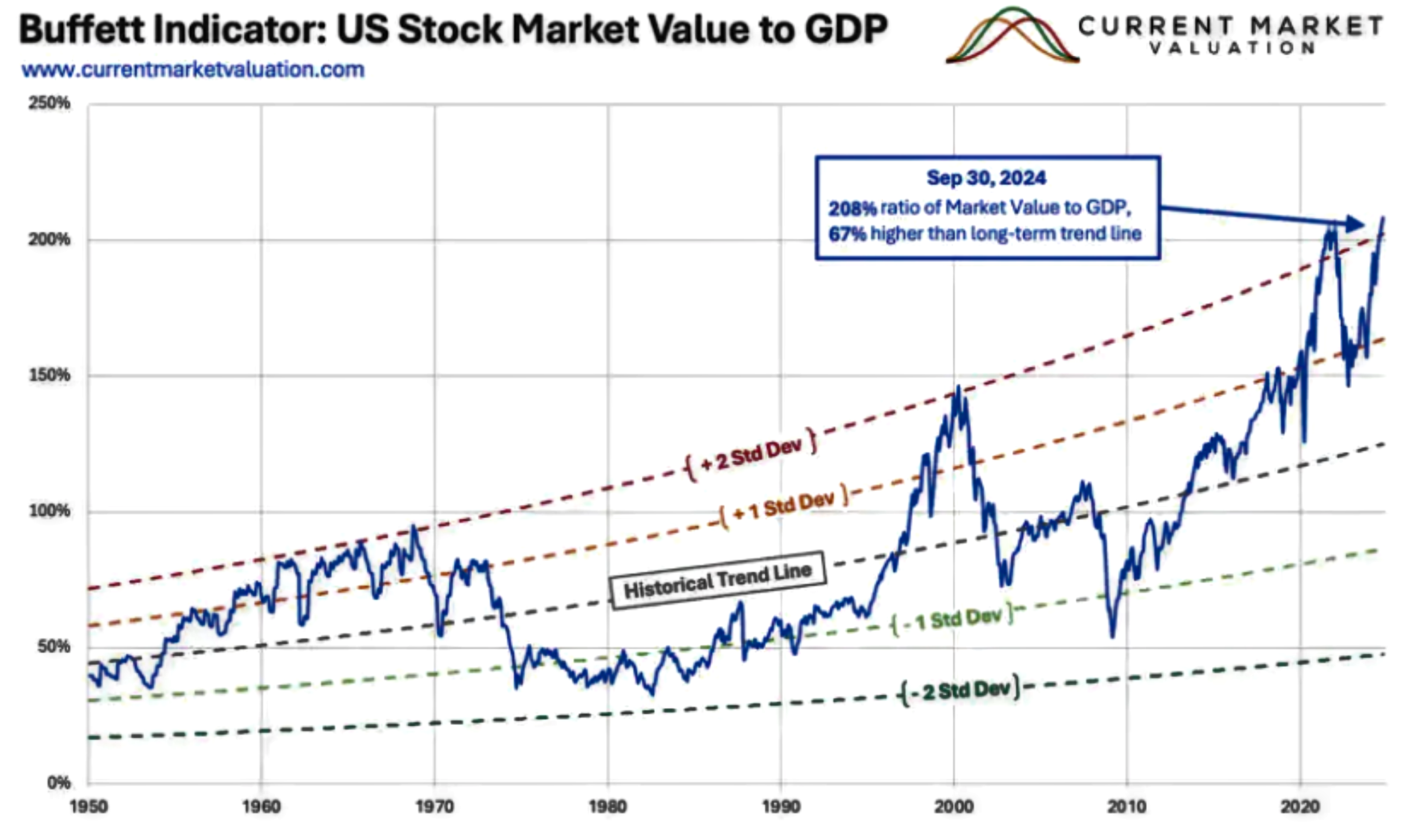

The Buffett Indicator, which measures the total market value of U.S. stocks relative to the country's GDP, is used to assess market valuation. A higher ratio suggests overvaluation, while a lower ratio suggests undervaluation.

As of September 30, 2024, the indicator stood at 200%, significantly above its long-term trend line and well beyond the two-standard deviation band, indicating extreme overvaluation compared to historical averages. The chart illustrates the indicator's historical fluctuations, revealing periods of both overvaluation and undervaluation, with the current reading exceeding the historical norm by 67%.

Just One Tool

The Buffett Indicator is a tool for assessing market valuation – just one, and not the only one. Use your own judgment, and consider other factors, like these, in your investment decisions:

- The Buffett Indicator as a long-term indicator may not be a good predictor of short-term market movements.

- The current overvaluation may be driven by a number of factors, such as large fiscal deficits, easy monetary policy, and strong corporate earnings.

- The market may continue to rise in the short term despite historic overvaluation.

Freeze? Maybe Not. Proceed with Caution

In the fourth quarter of every year, Highland updates our capital markets assumptions, taking into account market valuations. While an unreliable predictor of short-term returns, over the long run, valuations matter, and offer a principled, Buffett-like approach to investment management based on:

- Long-Term Perspective: While short-term market fluctuations can be volatile, long-term valuations ultimately shape investment outcomes.

- Valuation Discipline: Understanding the intrinsic value of an investment is paramount to making informed investment decisions.

- Prudent Investment Practices: A cautious approach, especially in periods of market exuberance, can help mitigate risk and protect capital.

By heeding the lessons from Warren Buffett's early successes and current activity, and by carefully considering market valuations as Highland does, investors can make more informed decisions and navigate market complexities with greater prudence. Buffett’s practices and his own story are a commentary on capital markets over the long-term. When something good ends (or hot markets cool), something better may be around the corner, and often is.

Just ask the lizard.

Highland Consulting Associates, Inc. was founded in 1993 with the conviction that companies and individuals could be better served with integrity, impartiality, and stewardship. Today, Highland is 100% owned by a team of owner-associates galvanized around this promise: As your Investor Advocates®, we are Client First. Every Opportunity. Every Interaction.

Highland Consulting Associates, Inc. is a registered investment adviser. Information presented is for educational purposes only and is not intended to make an offer of solicitation for the sale or purchase of specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.