The Power of the PENsion: Have We Stuck the Landing? (Or are we skating on thin ice?)

Earlier this month, the Federal Open Markets Committee (FOMC) unanimously agreed to hold the key federal funds rate in a target range of 5.25% to 5.5%. This short-term benchmark rate has been held steady since July 2023. With the decision to leave the rate unchanged, it might have seemed we’d stuck the landing—the economy’s soft landing the Fed has been aiming for. Markets rallied on the news of rates holding steady. The Dow Jones soared 212 points, and everyone exhaled. Oh, but wait.

Not So Fast

Just 5 days later, Fed Chair Jerome Powell said the Fed wouldn’t hesitate to tighten monetary policy and raise rates again if inflation persists. At an International Monetary Fund research conference, Powell said the Fed “is committed to achieving a stance of monetary policy that is sufficiently restrictive to bring inflation down to 2% over time. We are not confident that we have achieved such a stance.”

And the crowd (and the markets) went wild (so to speak). The Dow Jones closed down 200 points.

Upon Further Review

Sure enough, the Consumer Price Index (CPI) reported mid-month rose only 3.2% for the 12 months ended October 2023, down from 3.7% in September, lower than was expected, and registering the lowest annual rate since March 2021. This is great news, and the markets responded accordingly, but inflation still sits above the targeted rate of 2%. Moreover, the fed funds rate, while stable since July 2023, is at its highest level in 22 years. As a result, high mortgage rates are putting home ownership out of reach for many would-be buyers, while for savvy borrowers who took advantage of historically low interest rates in 2020 and 2021 by terming out their financing, a large number of refinancings is expected to begin in 2024 and gain momentum in the coming years. Consider the country's ongoing deficit spending despite a relatively robust, near-full-employment economy. High federal spending could spark inflation and cause interest rates to rise again.

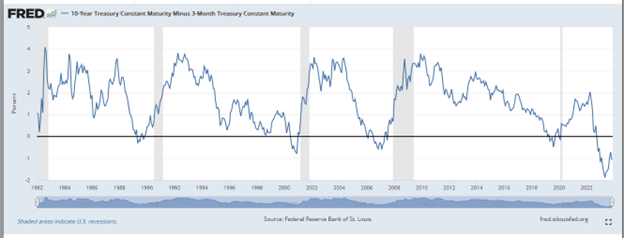

And then there’s the yield curve. Let’s not ignore it. Like a camera focused on the edges of a skater’s blades, it doesn’t lie. The yield curve continues to portend a shaky landing.

As we discussed here in 2022, the short end of the yield curve tends to follow central bank policy guidance, while the long end of the yield curve is a proxy for future growth and inflation expectations. So, a positively sloping yield curve signifies positive economic growth, which in turn encourages lenders to risk capital for longer periods of time. They demand a premium to lend longer as the prospect of being repaid decreases with time. This, then, creates an upwardly sloping curve which is generally associated with economic growth in a healthy economy. A flattening of the curve and beyond that, an inversion, most often signals economic weakness and investor worry.

In October 2022, the Treasury yield curve between the 10-year and 3-month tenors inverted for the first time, and it’s mostly stayed that way since. Historically, only when the yield curve begins to steepen again is a recession likely to have begun. Central banks, fearing a slowdown, begin to cut short-term rates in order to minimize the damage from the upcoming slowdown in the economy, and the yield curve re-establishes its upward slope.

So, upon further review, the landing may not be as clean as we’d hoped.

As figure skaters will attest, it takes conviction to launch a major move, and confidence to land it. Although Powell seems to lack confidence in our economy’s health, most investors seem to have priced in a soft landing.

Of course, If there’s a chink in the ice or some unexpected volatility, investors will have to react swiftly to regain their balance. Even so, well-positioned investors needn’t fear the unexpected. Well-formulated strategies, like routinized practices, allow for necessary adjustments to stick the landing and avoid a bruising fall.

If you’d like to talk further about the Fed’s next move, the forecasting power of the yield curve, or the challenges of sticking a landing, call Mike Paolucci at Highland Consulting Associates, 440-808-1500.

Highland Consulting Associates, Inc. was founded in 1993 with the conviction that companies and individuals could be better served with integrity, impartiality, and stewardship. Today, Highland is 100% owned by a team of owner-associates galvanized around this promise: As your Investor Advocates®, we are Client First. Every Opportunity. Every Interaction.

Highland Consulting Associates, Inc. is a registered investment adviser. Information presented is for educational purposes only and is not intended to make an offer of solicitation for the sale or purchase of specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.