DB Insight

Fiscal Dominance: How Pension Plan Sponsors May Have to Adapt

Photo credit: Pixabay Buckets of federal spending are swamping conventional inflation fighting tools. What plan sponsors should know. If you’ve ever tried bailing water out of a flooding basement with a bucket as your tool (as the water rises ever faster), you know something about fiscal dominance. The concept, or condition, is being talked about…

Read MoreThe Power of the PENsion: Am I a Plan Fiduciary? What Does That Mean?

Photo credit: iStock If your job responsibilities include involvement with an employee benefit plan, you may be a fiduciary, and so might others be who help manage the plan or its assets. Given that, it is important to know what a fiduciary is, who is deemed to be a fiduciary, and what the responsibilities are…

Read MoreSVB – A Year After the Bank’s Collapse

Photo Credit: Alexey Yarkin Short-sighted, Vulnerable, Broke Nearly a year ago, Silicon Valley Bank failed. On March 8, 2023, SVB announced a $1.75 billion capital raising effort, offering its common stock and depository shares. As the announcement moved through media outlets, the message heard was this: SVB is short on capital and it may not…

Read MorePower of the PENsion: Two-Faced January – Looking Back to Look Ahead at Capital Markets

Looking Back to Look Ahead at Capital Markets The month of January is named for the Roman god Janus, the god of thresholds and new beginnings. Janus is depicted with two heads signifying his look back to the past even as he looks forward to the future. At Highland, it’s been our practice to analyze…

Read MoreThe Power of the PENsion: Reality and Resolutions – Guaranteed Retirement Income

photo credit Unsplash The Reality Americans have experienced in recent years: a worldwide pandemic, inflation, interest rate increases and geopolitical issues. There is a general feeling of unease. Add to that baseline the anxiety that workers report (up 33% in 2023[i]) concern about their jobs, their earnings, and their future financial security. According to a…

Read MoreThe Power of the PENsion: Have We Stuck the Landing? (Or are we skating on thin ice?)

Earlier this month, the Federal Open Markets Committee (FOMC) unanimously agreed to hold the key federal funds rate in a target range of 5.25% to 5.5%. This short-term benchmark rate has been held steady since July 2023. With the decision to leave the rate unchanged, it might have seemed we’d stuck the landing—the economy’s soft landing…

Read MoreMinimum Required Contributions: It’s Time to Pay the Piper

Photo credit: Unsplash Rising rates and increasing economic pressures may surprise pension plan sponsors with MRCs not paid in years. But the gig is up. It’s time to pay the piper. In recent years, fall has tended to be an unremarkable time for pension plan sponsors. The plan’s AFTAP (adjusted funding target attainment percentage) valuation…

Read MoreThe Power of the PENsion: Count the Cost of Offering a Pension Plan

Comprehensive analysis of your plan may show the cost to be well worth your employees’ benefit What is the cost of providing a defined benefit pension plan? Beyond employer contributions, when determining costs, we consider custody, asset management, and consulting fees. These fees vary depending on the management of the plan and whether it is…

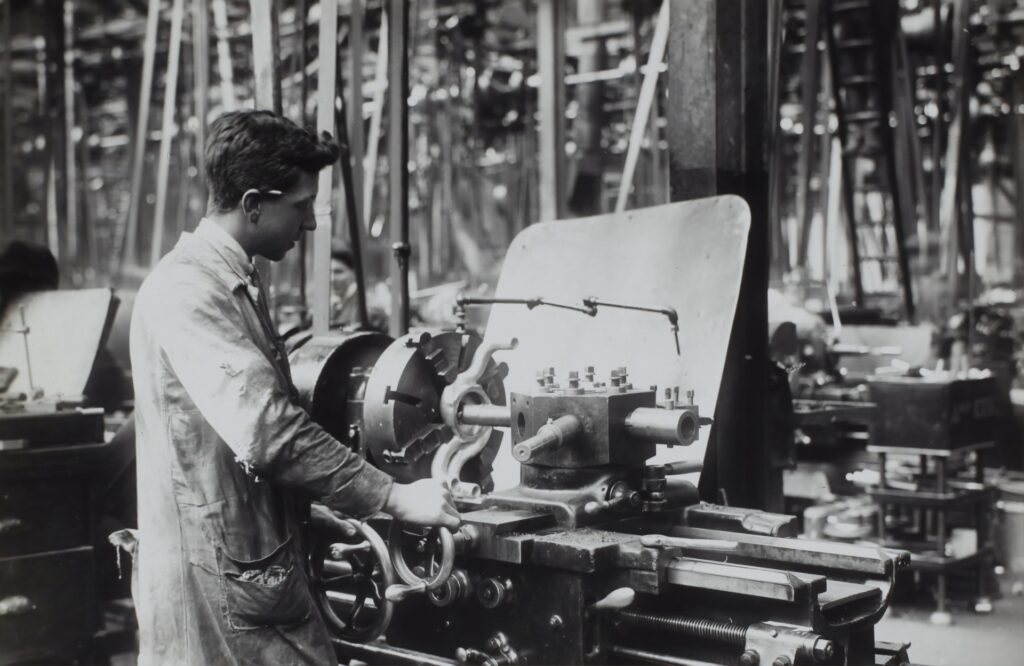

Read MoreThe Power of the PENsion: Labor Day and the Pension Plan

Pension Plans may be declining in numbers, but for millions of workers they are an essential retirement benefit with a history that is tied to Labor Day. Although summer may end officially on September 21, for most Americans, the season ends with Labor Day. The first Labor Day was celebrated in 1882. Far from marking…

Read MoreThe Power of the PENsion: Contributions – Pay Now or Later?

It may be a Prime Day to consider your pension plan contributions. You can pay now or later and there are benefits and risks to each decision. Amazon’s annual Prime Day event ran for two days on July 11 and 12. Nothing raises consumer now-or-later decisions quite like it. For 2023, the number one item…

Read More