Insight

The Power of the PENsion: Count the Cost of Offering a Pension Plan

Comprehensive analysis of your plan may show the cost to be well worth your employees’ benefit What is the cost of providing a defined benefit pension plan? Beyond employer contributions, when determining costs, we consider custody, asset management, and consulting fees. These fees vary depending on the management of the plan and whether it is…

Read MoreInevitabilities: Death, Taxes…and Audits?

Benjamin Franklin is often quoted for having said there are two certainties in life: death and taxes. But, as mid and large plan sponsors of defined contribution (DC) plans can attest, their annual benefit plan audit is another certainty. And let’s not overlook the possibility of a regulatory audit. Regarding the latter, there’s been significant…

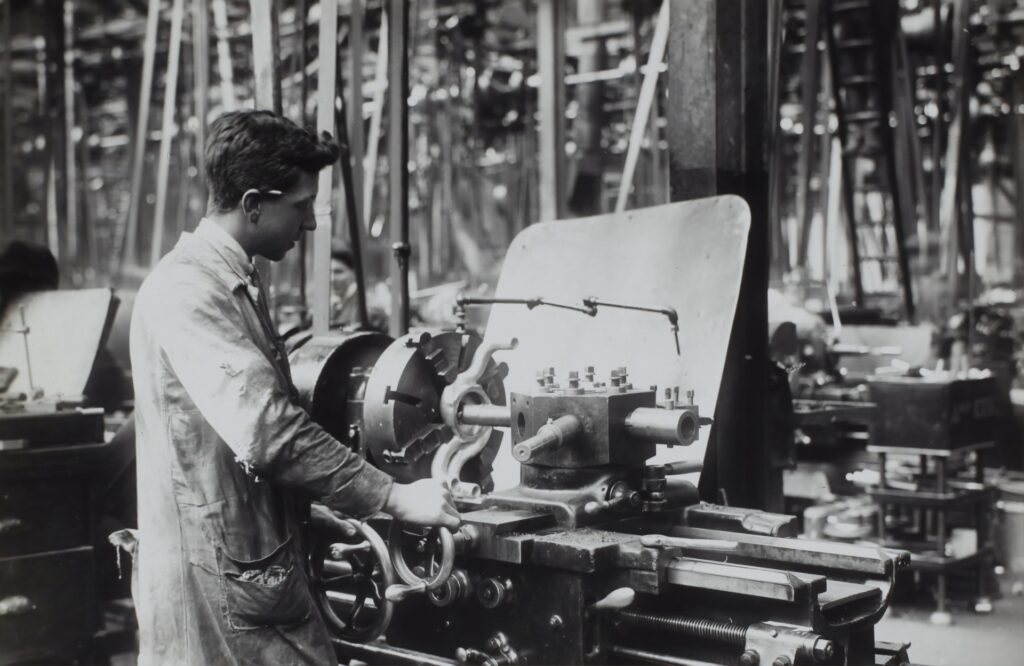

Read MoreThe Power of the PENsion: Labor Day and the Pension Plan

Pension Plans may be declining in numbers, but for millions of workers they are an essential retirement benefit with a history that is tied to Labor Day. Although summer may end officially on September 21, for most Americans, the season ends with Labor Day. The first Labor Day was celebrated in 1882. Far from marking…

Read MoreCome Together: Nonprofits Pool Plans

Pooled plans are now for nonprofit organizations. U.S. nonprofits account for 10% of the U.S. workforce, trailing only retail and manufacturing[i]. Not only that, but the sector has grown dramatically over the last 15 years[ii]. For nonprofits wanting to attract and retain employees (most often, employees who share a commitment to the nonprofit’s mission), offering…

Read MoreThe Power of the PENsion: Contributions – Pay Now or Later?

It may be a Prime Day to consider your pension plan contributions. You can pay now or later and there are benefits and risks to each decision. Amazon’s annual Prime Day event ran for two days on July 11 and 12. Nothing raises consumer now-or-later decisions quite like it. For 2023, the number one item…

Read MoreThe Power of the PENsion

Private sector pension plans originated as early as 1875. By 1950, in our post-war manufacturing economy, more than 25% of the private sector workforce had a pension (or defined benefit) plan, offering employer-funded benefits with guaranteed payment (in lump-sum or in payment streams) at retirement. The advent of defined contribution plans like 401(k) plans, with…

Read MoreThe Mirror of Erised

In preparation for a trip to Europe with our son and his wife, both big Harry Potter fans, it made sense to watch at least one movie from the series to familiarize myself with the characters. In the first movie, I was fascinated to learn about the Mirror of Erised. Albus Dumbledore (known as the…

Read MoreFiduciary Training: Put Fear to Rest

Fear is a powerful motivating force. Advertisers are keenly aware of this and market products to spur consumers to action. FOMO, “fear of missing out,” is part of our modern-day lexicon. More obscure is liticaphobia, the irrational fear of lawsuits or being sued by someone. This fear is based on an unfounded sense that you…

Read MoreRFPs: Reframing For Productivity

Unlocking the Power of Unconventional Thinking in Your Next RFP. Most pension plan sponsors engage in a “request for proposal” (RFP) process on a periodic schedule to fulfill their fiduciary obligations. Importantly, the RFP process helps to gauge the value of provider services to the plan and the reasonableness of those associated fees. Very likely,…

Read MoreMillennials Investing in a New(er) Millennia

Gone are the days of calling a stockbroker to hear the latest picks to then place a trade with a $50 commission for a mutual fund with a 2% expense ratio. Today, the average American 20-something with a phone and a brokerage account can place a zero-commission trade for any security on an exchange in…

Read More