Uncategorized

November 2024

Summary U.S. stocks rallied in November as investors responded favorably to a clear-cut presidential election result. Interest rates increased on the news of a President Trump return to the White House before easing a bit by month end. The Federal Reserve cut rates by 25 basis points, reiterating a commitment to a gradual easing of…

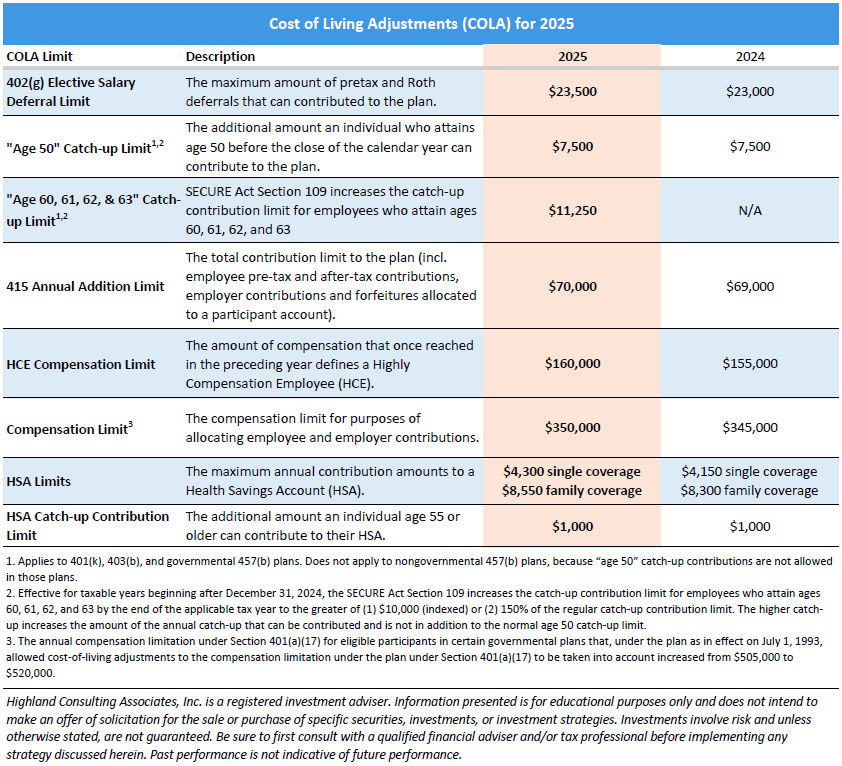

Read MoreCost of Living Adjustments 2025

The IRS recently released the Cost-of-Living Adjustments (COLA) for 2025 related to 401(k) and Health Saving Accounts. This table provides these and other limits that are of interest to many plan sponsors and their participants. If you would like more information please call us at 440-808-1500. Highland Consulting Associates, Inc. was founded in 1993 with the…

Read MoreOctober 2024

Summary Markets gave back gains in October with most major indexes finishing the month in the red. Bond yields moved higher as September’s rate cut euphoria wore off in emphatic fashion. Stocks tumbled with markets keying in on a toss-up U.S. presidential election. U.S. GDP growth slowed in the third quarter but remained respectable at…

Read MoreTimes Are Changing – Should You?

photo credit: Pixabay In recent years, cash has enjoyed a period of higher yields, thanks to recent central banks’ aggressive interest rate hikes aimed at curbing inflation. This has made cash and cash-equivalents—such as savings accounts, money market funds, and short-term government securities—more attractive than they have been in over a decade. However, with rate…

Read MoreClients Ask: What Is a Yield Curve Dis-inversion?

Photo credit: Pixabay Clients Ask What is a Yield Curve Dis-inversion? Will Fed Rate Cuts Help a Slowing Economy? Or Will Fed Rate Cuts Re-ignite Inflation? Highland Responds After an extended period of inversion, the U.S. yield curve has recently undergone a significant change by dis-inverting. Our Highland clients have wanted to know what this…

Read MoreSeptember 2024

Summary Markets rallied across the board in September as the Federal Reserve made good on a well-telegraphed rate cut, trimming the Fed Funds rate by 50 basis points. The 2-year Treasury rate dipped below the 10-year yield for the first time since the summer of 2022, U.S. stocks marched higher, and the dollar weakened, providing…

Read MoreAugust 2024

Summary August typically brings calmer markets and light trading volumes, with investor interests skewed more towards wrapping up the last of summer vacations. In this sense, August 2024 was anything but typical. Surprise activity from the Bank of Japan thrust global markets briefly into chaos before a just-as-abrupt rebound. Cooler inflation and negative jobs revisions…

Read MoreBuckle Up: A Wild Ride Part 2

Photo credit: Unsplash Unprecedented Movements in the Market: What’s Happening? In early August 2024 stock markets around the world declined precipitously, ending what seemed to be a never-ending low volatility trading environment. From peak to trough, the S&P 500 index declined approximately 10% in a handful of trading days; the volatility index as measured by…

Read MoreJuly 2024

Summary July was a remarkable and volatile month, as stocks were mixed and bonds generated positive returns. Large cap stocks saw their first 2% single-day drawdown of the year and many of the big tech names which drove 2024’s AI-fueled rally sold off during July, while the Russell 1000 still managed to finish the month…

Read MoreHow Did You Get There?

photo credit: Unsplash Ernest Hemingway asked this question through a key character in his book “The Sun Also Rises.” The question was: “How did you go bankrupt?” The answer: “Two ways. Gradually, then suddenly.” The response, “gradually then suddenly,” is a great encouragement and a caution to us. It never ceases to amaze how this…

Read More