Forecasting Equity Returns – What Can I Count On in 2024? Part Three: Smoke and Mirrors Day – A Celebration of Small Caps, Global Funds and Emerging Markets

Photo credit: Pixabay

A three-part conversation with Highland Consulting Associates.

Over the past several weeks we have been considering what you can expect from investment returns in 2024—or, rather, whether you can count on 2024 predictions at all. We’ve organized this series into three parts (see Part One and Part Two) to cover the major areas of investment opportunities beginning with equities, followed by consideration of fixed income and then, portfolio construction.

Part Three: Smoke and Mirrors Day: A Celebration of Small Caps, Global Funds and Emerging Markets

Smoke and Mirrors Day, little recognized outside of Las Vegas, celebrates illusions and magic every year on March 29th. In our case, it leads to a closer look at small caps, global, and emerging markets funds as components of our returns expectations for 2024. We often expect these funds to perform better but we have obvious handicaps in Forecasting their returns with precision. What should be true (or has been hoped for or expected) hasn’t borne out. Not really smoke and mirrors or a sleight of hand, these less predictable returns attest to their inherent risk.

Beyond the Borders of Large Caps

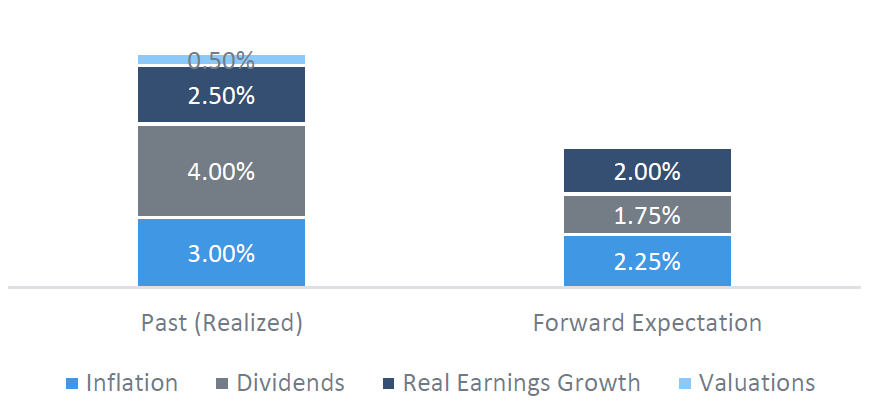

The methodology we relied on in our first two considerations (Part One; Part Two) to get to our baseline equity expectations can be applied elsewhere with a few tweaks to capture any distinct market features. In our last discussion, we suggested the forward-looking returns might look something like this:

Past Equities Returns vs. Forward Expectations

Source: Highland Consulting Associates, Inc.

Now, if we turn to domestic small cap stocks, where return expectations (and risk) have tended to come in higher than large and megacap stocks, the same exercise applies directly. We assume inflation is the same 2-2.5%. Dividend yields can be pulled from the appropriate index. As an example, for the Russell 2000, dividend yields have been in line with large cap peers at about 1.5-2%. Earnings growth is the wildcard. It can make sense to apply a higher rate of growth for small caps (a proxy for the small cap premium observed in historical returns). But how much should we add? Long-term outperformance suggests a small cap premium around 1%, but feel free to use your discretion! This is where the art of investment management meets its science counterpart. What’s important to note here is that the difference between small and large cap expectations is just the growth premium, which, in the current environment, we forecast to be 1%. So, if large cap expectations are 5.5-6%, then small cap expectations should be 1% higher at 6.5-7%. (And as for the contribution of valuation, recall that since historical valuations have varied widely in supercycles, rendering that input almost meaningless, we’re omitting the figure from our forward summation.)

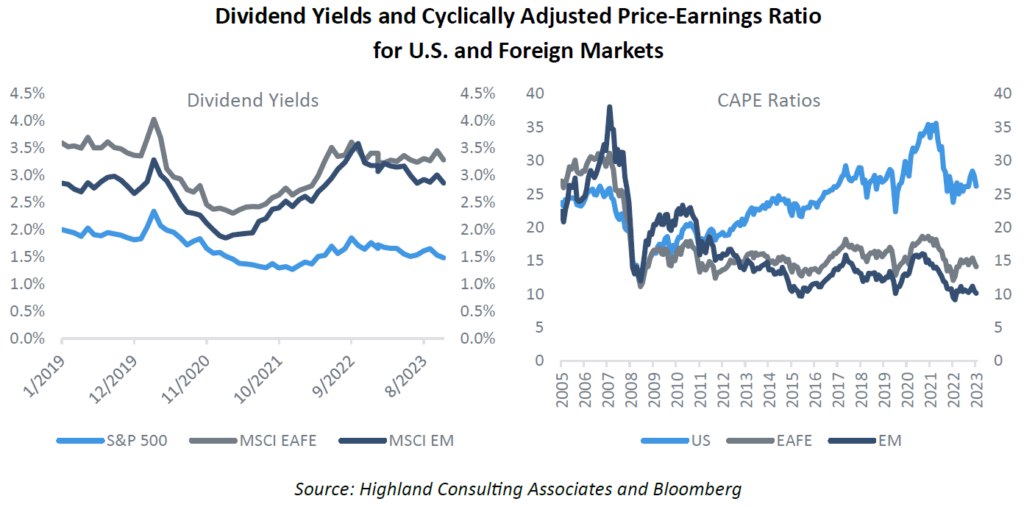

Outside of the U.S. there are more interesting conversations to be had. Should we adjust inflation expectations in Europe or Japan? What about emerging markets? Dividend yields on both the MSCI EAFE and MSCI EM index have exceeded those stateside, which should bolster our outlook. Emerging markets definitely offer more economic growth potential and may be worthy of a boost to the earnings growth component, the same way we gave small caps an extra bump. Does currency matter? And can we confidently forecast the long-term path the dollar will take? Then there’s valuations outside our U.S. borders—let’s just leave that on the table for another time.

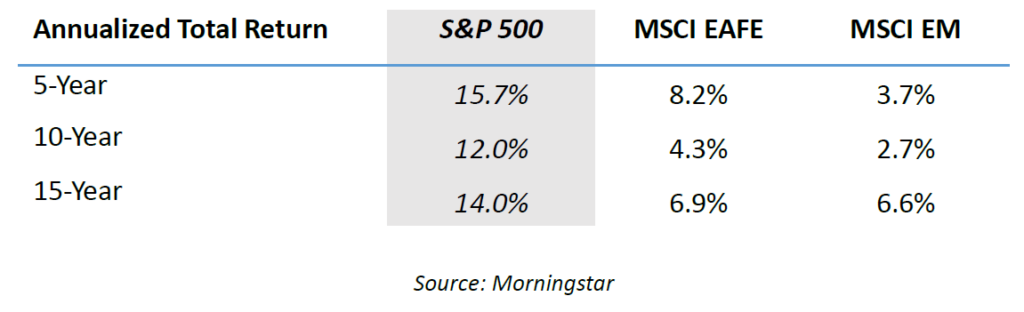

On balance it would seem that non-U.S. equities offer better potential than their U.S. counterparts. The bad news is that this has been the case for several years, and it’s a thesis that has not paid off in practice. Case in point, domestic stocks have managed to outperform non-U.S. stocks over medium- and long-term time horizons thanks in large part to the valuation divergence that kicked off in the wake of the 2008-2011 crisis period.

So those failed predictions aren’t smoke and mirrors, they just point out the unpredictable nature (risk) of foreign and emerging market economies and company profits.

Conclusion: What Returns Can We Count on in 2024?

In three conversations, we considered how to forecast market returns in 2024. We’ve looked at historic returns. We’ve considered the parts of the Pi (or pie). And finally, we’ve looked beyond our borders to see what non-U.S. equities and emerging markets can contribute.

What we’ve learned is the value of this expression: “We learn from the past, live in the present, and plan for the future.” Remember, the goal isn’t to predict the future precisely. That deck is firmly stacked against that, and we are destined to be wrong in the end. But with a little critical thinking, some data and insight, we can look into the future armed with a logical model rooted in reality.

Though we might be wrong--precisely, we can hope to be wrong in the right direction.

Your Investor Advocates® spend all day every day analyzing markets and what they tell us about the economy, the future, and the prospects for financial health for our clients and those who count on them. We’d love to discuss what we do on behalf of our clients with you. Please contact Mike Grater at Highland at 440-808-1500.

Highland Consulting Associates, Inc. was founded in 1993 with the conviction that companies and individuals could be better served with integrity, impartiality, and stewardship. Today, Highland is 100% owned by a team of owner-associates galvanized around this promise: As your Investor Advocates®, we are Client First. Every Opportunity. Every Interaction.

Highland Consulting Associates, Inc. is a registered investment adviser. Information presented is for educational purposes only and is not intended to make an offer of solicitation for the sale or purchase of specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.