DC Insight

The Silence Before the Storm: Legendary Investors and Market Signals

Photo credit: Pixabay For decades, investors have sought clarity in a noisy financial world. While no single indicator can perfectly predict a market peak, the actions and commentary of seasoned, valuation-conscious investors—those who have successfully navigated multiple cycles—often provide signals worth heeding. When these figures, typically advocates of long-term optimism, begin to show caution through…

Read MoreIs AI Heading Toward a Capital Expenditure Bubble?

Photo credit: ideogram.ai The debate over whether artificial intelligence (AI) is inflating a financial bubble has intensified, drawing unsettling parallels to the dot-com era’s excesses. A complex web of deals, surpassing $1 trillion, reveals circular financing at play, where massive investments such as a $100 billion infusion into a leading AI firm loop back as…

Read MoreSpeculative Assets in Retirement Plans: A Prudent Perspective

photo credit: Ideogram In our prior article, we examined the growing interest in private equity in 401(k) plans. That discussion, centered around illiquidity and fiduciary responsibility, provides important context for the next frontier: speculative assets. Recently, the Administration asked the Department of Labor (DOL) to further review their use in retirement plans. For plan sponsors,…

Read MoreRoth Catch-Up Contributions: The Long-Awaited Rules Have Finally Landed

photo credit: Ideogram After months of circling the regulatory runway, the IRS has released final regulations under the SECURE 2.0 Act, including long-anticipated guidance on Roth catch-up contributions. These rules provide much-needed clarity for employers preparing to implement the Roth catch-up provision in 2026. While the regulations officially apply to tax years beginning after December…

Read MoreIs Your 401(k) Ready for Private Assets? A Look Beyond the Promise

photo credit: Ideogram As the landscape of retirement savings continues to evolve, new proposals and potential opportunities emerge, promising enhanced returns and greater diversification for plan participants. Recently, discussions in Washington, D.C. have centered on the possibility of allowing private assets to become a more accessible component of 401(k) plan lineups, either as standalone options…

Read MoreThe Buffett Indicator

Photo credit: ID 336907040 © Yaroslaf | Dreamstime.com What do lizards, Blizzards, and underwear have in common? Warren Buffett and Berkshire Hathaway. And do the lizard and the DQ Blizzard (and Berkshire Hathaway holdings, in general) predict a freeze in an exceedingly hot investment market? Possibly. More on that later. The Omaha-based conglomerate counts GEICO, Dairy Queen, and Fruit of…

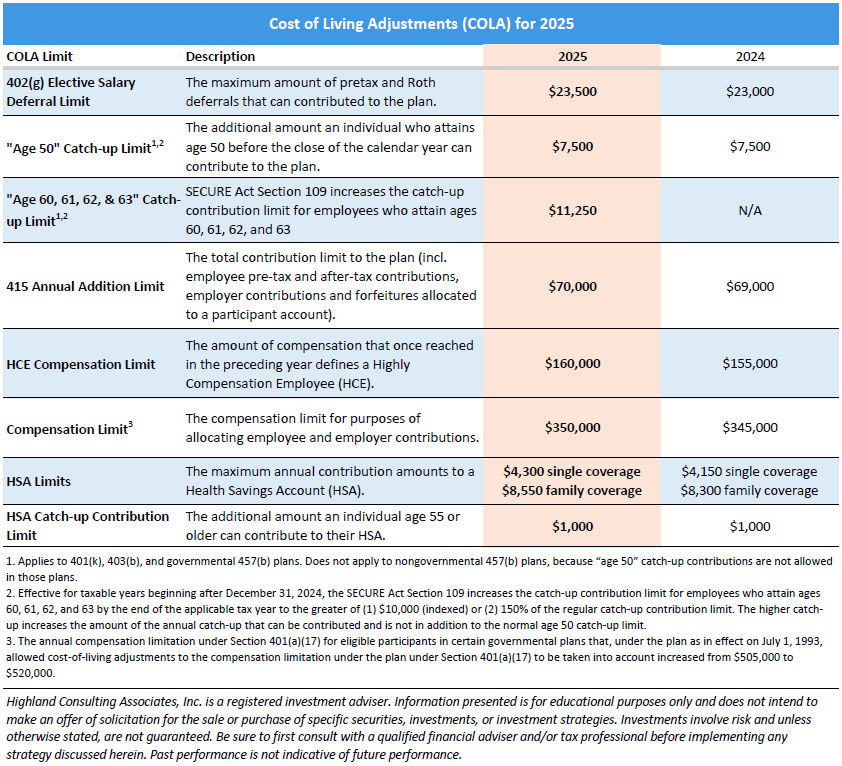

Read MoreCost of Living Adjustments 2025

The IRS recently released the Cost-of-Living Adjustments (COLA) for 2025 related to 401(k) and Health Saving Accounts. This table provides these and other limits that are of interest to many plan sponsors and their participants. If you would like more information please call us at 440-808-1500. Highland Consulting Associates, Inc. was founded in 1993 with the…

Read MoreThe Elusive 5%: Is It Making a Comeback?

photo credit: Pixabay For over a decade, we lived in a world of near-zero interest rates, making it incredibly challenging for plan sponsors and corporate asset managers to create low-risk portfolios yielding 5%. But as market dynamics shift, the landscape is changing, bringing new opportunities—and new decisions—to the forefront. The Challenge of the Last Decade…

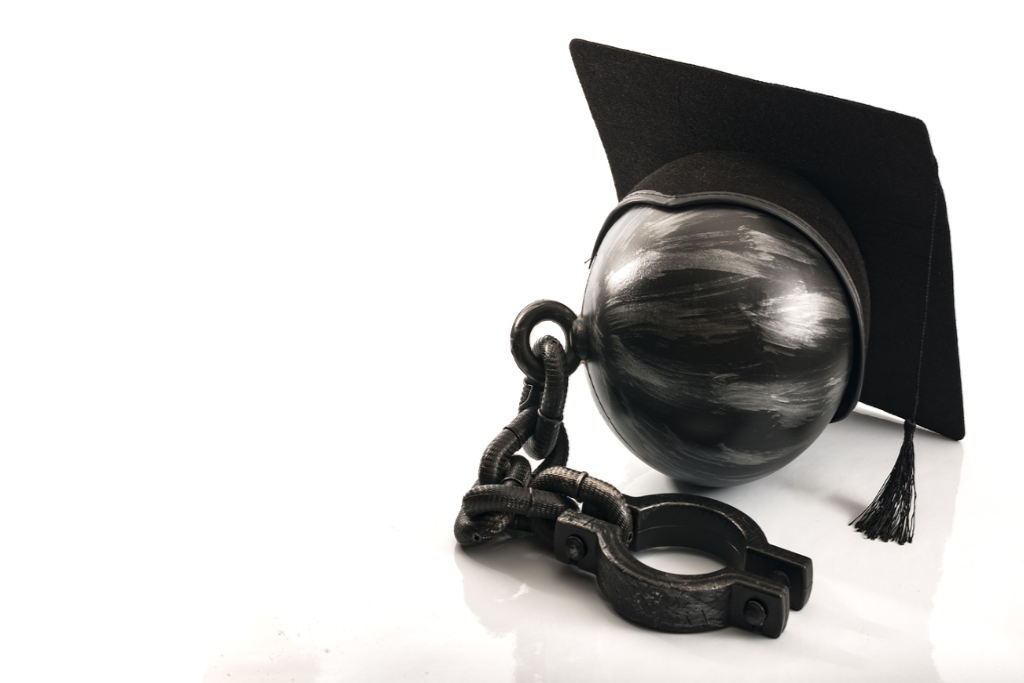

Read MoreSecure Act 2.0 Student Loan Match – Lightening the Student Debt Load to SECURE a Better Retirement

photo credit: istock “A hundred wagonloads of thoughts will not pay a single ounce of debt.” – Italian proverb As of 2023, 43 million Americans held $1.6 trillion[i] in student loan debt. That’s a wagonload of debt accumulated in the pursuit of higher thought. That burden of student loan debt is hindering retirement savings. Case…

Read MoreHappy 5/29 Day!

photo credit: Unsplash Happy 5/29 Day! Today we celebrate the 529 Plan, a college savings vehicle with tax-free withdrawals. What Is a 529 Plan? What Are the Benefits? This beneficial tax treatment comes with a few strings attached: While not federally tax deductible, contributions in certain states are state income tax deductible The money must…

Read More