Insight

Clients Ask: What Is a Yield Curve Dis-inversion?

Photo credit: Pixabay Clients Ask What is a Yield Curve Dis-inversion? Will Fed Rate Cuts Help a Slowing Economy? Or Will Fed Rate Cuts Re-ignite Inflation? Highland Responds After an extended period of inversion, the U.S. yield curve has recently undergone a significant change by dis-inverting. Our Highland clients have wanted to know what this…

Read MoreBuckle Up: A Wild Ride Part 2

Photo credit: Unsplash Unprecedented Movements in the Market: What’s Happening? In early August 2024 stock markets around the world declined precipitously, ending what seemed to be a never-ending low volatility trading environment. From peak to trough, the S&P 500 index declined approximately 10% in a handful of trading days; the volatility index as measured by…

Read MoreWhat’s the Cure for Fed Fatigue: Would You Believe Math?

photo credit: Unsplash How fixed income investing can alleviate interest rate stress and how you can forecast fixed income returns. Do you suffer from Fed Fatigue? The Federal Reserve Bank has dominated financial headlines lately. Will they, or won’t they? Do they dare drop rates? Will stubborn inflation take rates higher? It’s tiring to predict…

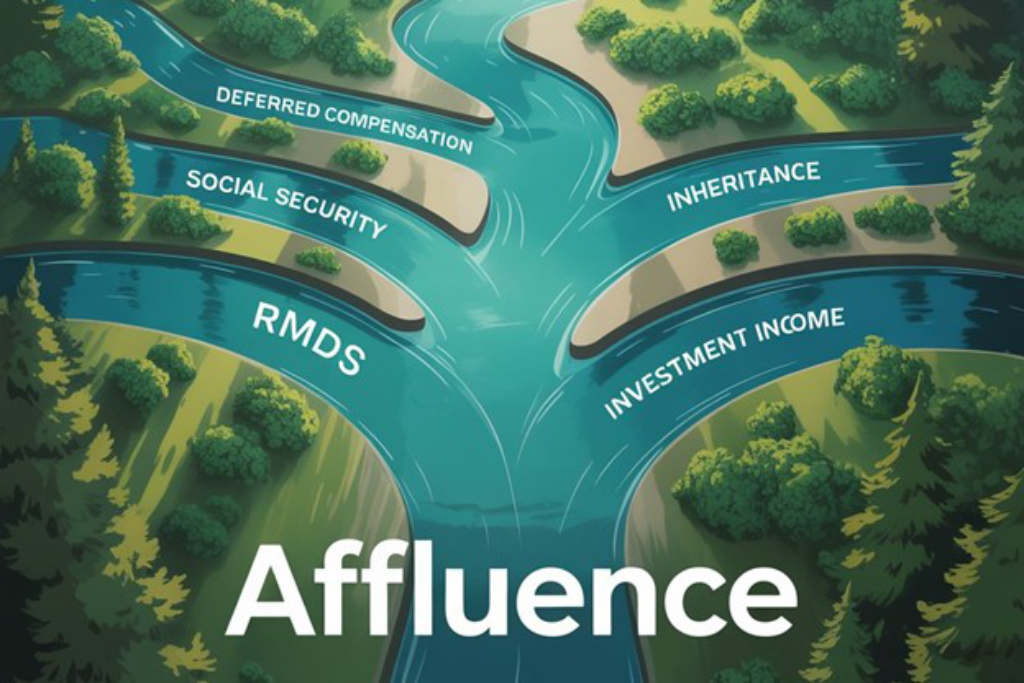

Read MoreHow Did You Get There?

photo credit: Unsplash Ernest Hemingway asked this question through a key character in his book “The Sun Also Rises.” The question was: “How did you go bankrupt?” The answer: “Two ways. Gradually, then suddenly.” The response, “gradually then suddenly,” is a great encouragement and a caution to us. It never ceases to amaze how this…

Read MoreFiscal Dominance: How Pension Plan Sponsors May Have to Adapt

Photo credit: Pixabay Buckets of federal spending are swamping conventional inflation fighting tools. What plan sponsors should know. If you’ve ever tried bailing water out of a flooding basement with a bucket as your tool (as the water rises ever faster), you know something about fiscal dominance. The concept, or condition, is being talked about…

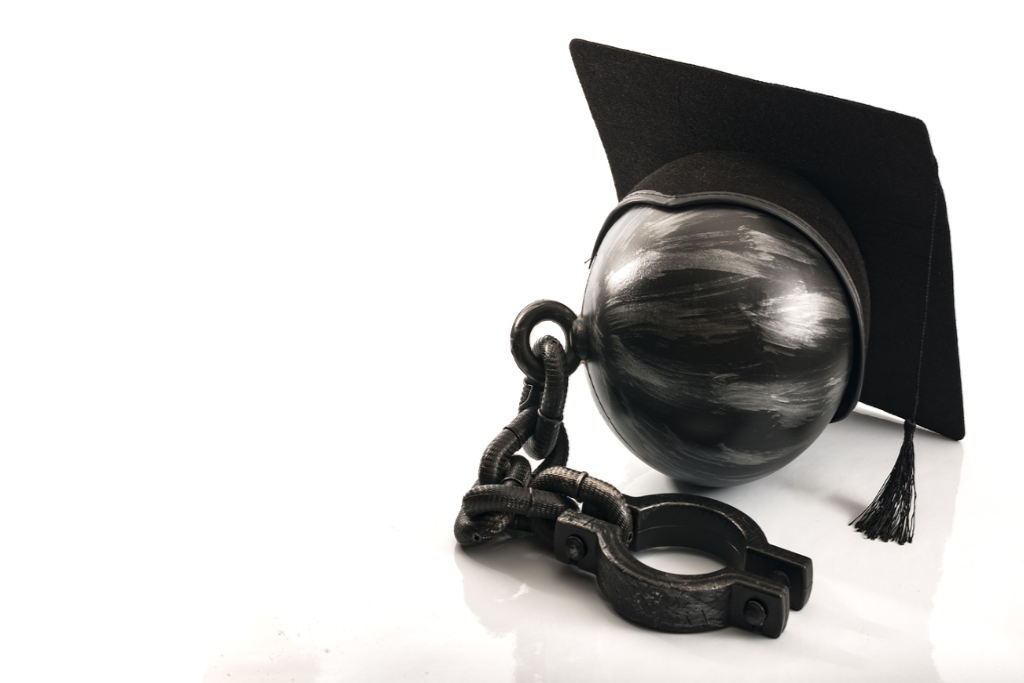

Read MoreSecure Act 2.0 Student Loan Match – Lightening the Student Debt Load to SECURE a Better Retirement

photo credit: istock “A hundred wagonloads of thoughts will not pay a single ounce of debt.” – Italian proverb As of 2023, 43 million Americans held $1.6 trillion[i] in student loan debt. That’s a wagonload of debt accumulated in the pursuit of higher thought. That burden of student loan debt is hindering retirement savings. Case…

Read MoreHappy 5/29 Day!

photo credit: Unsplash Happy 5/29 Day! Today we celebrate the 529 Plan, a college savings vehicle with tax-free withdrawals. What Is a 529 Plan? What Are the Benefits? This beneficial tax treatment comes with a few strings attached: While not federally tax deductible, contributions in certain states are state income tax deductible The money must…

Read MoreForecasting Equity Returns – What Can I Count On in 2024? Part Three: Smoke and Mirrors Day – A Celebration of Small Caps, Global Funds and Emerging Markets

Photo credit: Pixabay A three-part conversation with Highland Consulting Associates. Over the past several weeks we have been considering what you can expect from investment returns in 2024—or, rather, whether you can count on 2024 predictions at all. We’ve organized this series into three parts (see Part One and Part Two) to cover the major…

Read MoreThe Power of the PENsion: Am I a Plan Fiduciary? What Does That Mean?

Photo credit: iStock If your job responsibilities include involvement with an employee benefit plan, you may be a fiduciary, and so might others be who help manage the plan or its assets. Given that, it is important to know what a fiduciary is, who is deemed to be a fiduciary, and what the responsibilities are…

Read MoreForecasting Equity Returns – What Can I Count On in 2024? Part Two: What are the Pieces of the Pie? (And Is Your Pie Getting Smaller?)

Photo credit: Pixabay A three-part conversation with Highland Consulting Associates. In the next several weeks we’ll consider what you can expect from investment returns in 2024—or, rather, whether you can count on 2024 predictions at all. We’ll break this series into three parts to cover the major areas of investment opportunities beginning with historical returns,…

Read More